Martin Armstrong's blog

Posted Feb 10, 2016 by dev

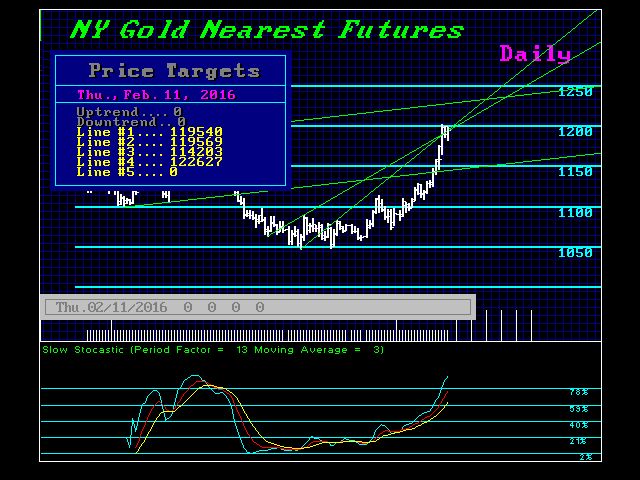

Gold closed higher today suggesting that we should press higher probably into Friday. Our opening pivot point in 1207.57 which is still well above the closing warning that the upside is still in play. Technically, resistance starts at the 1226 area. If we can achieve a closing above the 1209 level on Friday, then we can see an extreme short-cover rally into the 1300 area. A month-end closing BELOW 1181 would warn that a February high should stand. At the very least, we need a month-end closing ABOVE 1209 to imply any short-term sustainability.

Keep in mind this first quarter reaction is the first wake-up call. Gold is being impacted by a pending banking crisis unraveling in Europe. This has nothing to do with US markets, the quantity of money, and certainly not inflation. The Sovereign Debt Crisis begins in Europe. It will eventually hit Japan, and then the USA but probably not until late 2017. It appears that the bull market for private assets in general on a global scale will unfold between 2017 and 2020.

No comments:

Post a Comment