The Dow What Next

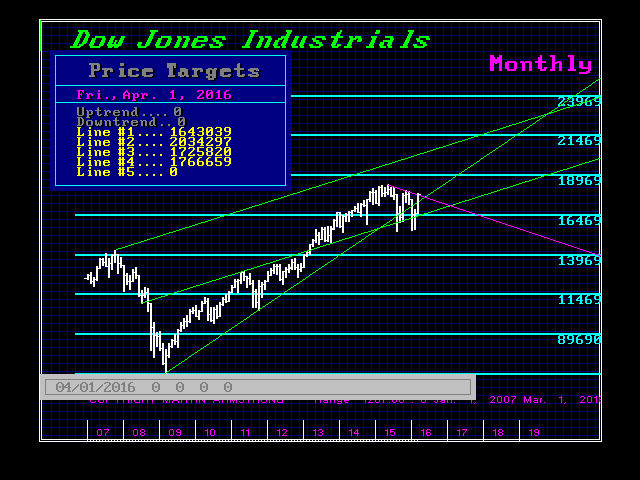

The Dow failed to elected any Monthly or Quarterly Bullish Reversals. It did elect two of the three Weekly Bullish leaving the 3rd intact. We provided these previously warning not to expect follow-through without electing all three.

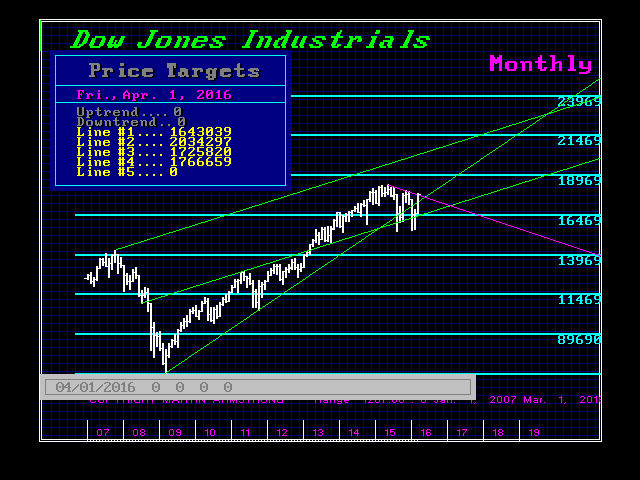

We also warned that closing only above 17750 reversal would see little follow-through into the next week. Why would we say such a thing? When you look at the fact that April is a turning point and so is June and then we get to August when we have concluded the Republican Convention, it does not appear that we are yet in a runaway trend to the upside. We are preparing to breakout, but not quite ready for prime time.

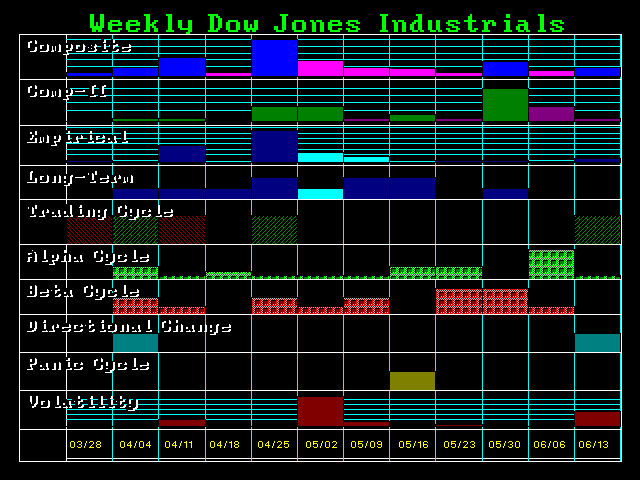

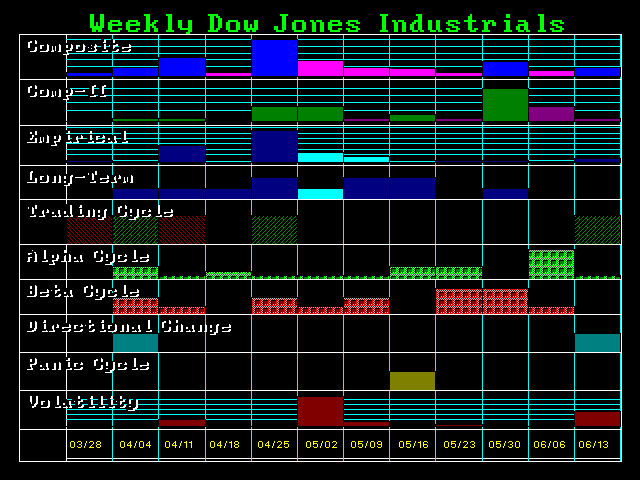

Moreover, the weekly array also show a choppy trend just yet with the weeks of the 11th and 25th and volatility beginning to rise in May. So once again, there does not appear to be a trend with clear sailing emerging just yet.

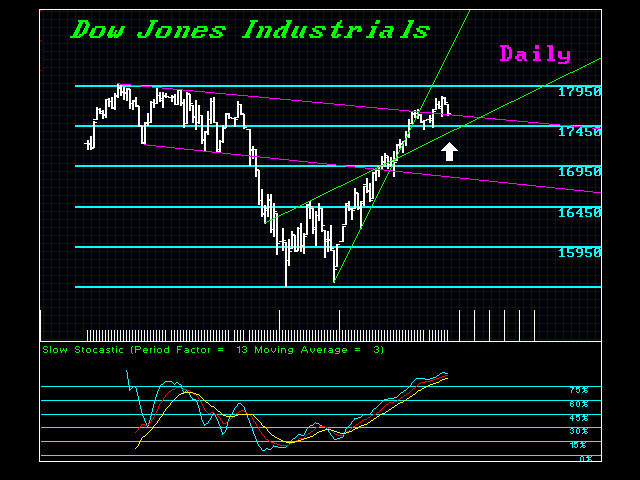

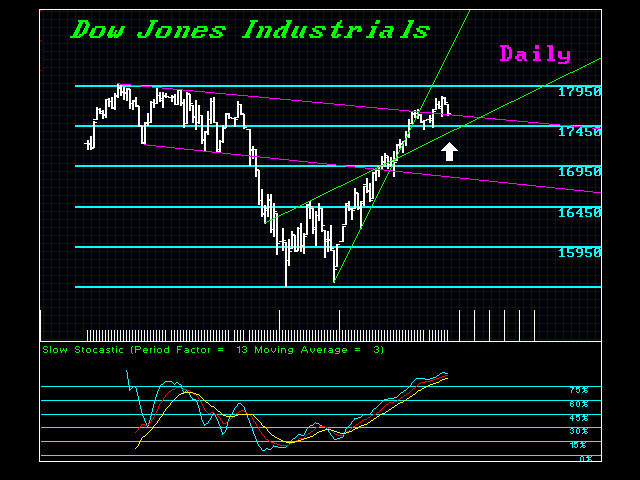

Nevertheless, even technically, the Dow is showing it is penetrating resistance attempting to muscle its way ahead despite those yelling there will be a huge crash once again.

It does not appear that we are ready for complete lift-off until the first quarter 2017. It appears that we are looking at a collapse in public confidence and that is what we need for lift-off in this shift from public to private confidence. The Panama Papers will help with time. All governments are corrupt. That is an foregone conclusion. The question remains, when will the general public reach that reality that they are not there to protect the future, only fill their own pockets no different than the communist leaders before 1989.

So support now lies at 17434 and 17120. Daily closings below these numbers will signal a near-term correction. Holding 17434 on a closing basis in any retest of support signals a revisit of the resistance. Only a weekly closing above 17846 will signal a retest of the major high. Do not expect a breakout until 2017.

Posted Apr 6, 2016 by Martin Armstrong

The Dow failed to elected any Monthly or Quarterly Bullish Reversals. It did elect two of the three Weekly Bullish leaving the 3rd intact. We provided these previously warning not to expect follow-through without electing all three.

We also warned that closing only above 17750 reversal would see little follow-through into the next week. Why would we say such a thing? When you look at the fact that April is a turning point and so is June and then we get to August when we have concluded the Republican Convention, it does not appear that we are yet in a runaway trend to the upside. We are preparing to breakout, but not quite ready for prime time.

Moreover, the weekly array also show a choppy trend just yet with the weeks of the 11th and 25th and volatility beginning to rise in May. So once again, there does not appear to be a trend with clear sailing emerging just yet.

Nevertheless, even technically, the Dow is showing it is penetrating resistance attempting to muscle its way ahead despite those yelling there will be a huge crash once again.

It does not appear that we are ready for complete lift-off until the first quarter 2017. It appears that we are looking at a collapse in public confidence and that is what we need for lift-off in this shift from public to private confidence. The Panama Papers will help with time. All governments are corrupt. That is an foregone conclusion. The question remains, when will the general public reach that reality that they are not there to protect the future, only fill their own pockets no different than the communist leaders before 1989.

So support now lies at 17434 and 17120. Daily closings below these numbers will signal a near-term correction. Holding 17434 on a closing basis in any retest of support signals a revisit of the resistance. Only a weekly closing above 17846 will signal a retest of the major high. Do not expect a breakout until 2017.

No comments:

Post a Comment