Posted Oct 16, 2017 by Martin Armstrong

QUESTION:

Bitcoin + Cryptocurrencies

Firstly, thank you – I’ve learned more from your blog and models that high-school would ever have hoped to teach me. And even after a year I am a still at the start-line of knowledge.

I am also been a follower and investor/gambler on crypto for over a year.

I concur with your findings that Govt’ will ultimately try to ban or regulate to tax crypto currencies. It really is all about tax. nothing else. I really don’t see how it can have anything to do with terrorist funding and the need to track all transactions, considering that as far back as 1996 the Federal Reserve that “ about $200 billion to $250 billion of U.S. currency was abroad at the end of 1995, or more than half the roughly $375 billion then in circulation outside of banks.” So how do the track this cash? or do they really care?

But what happens if the people just ignore the gov’t(s) attempt to ban crypto? What then?

Is it likely, or even remotely possible that most gov’ts would work jointly and simultaneously to ban crypto currencies?

Will there always be several countries that will ignore / not join this movement to benefit from the flow of currency – even if this inflow is crypto currency or not hard currency?

What will happy if the people just revolt and ignore the gov’’s efforts to tax crypto or ban it?

Some insight on how and what happened with previous alternative currencies who help shed some light on this. Could you also recommend some reading in this area.

Thanks again for your patience and skill in translating your work into digestible English so people like myself can benefit from your knowledge

D

ANSWER: This is a battle to the death. A cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency. However, this idea has also falsely embraced the notion that a cryptocurrency will be a store of value and hence defeat inflation. That has proven to be absolute nonsense. The rise of cryptocurrency is a reflection that people do not trust government. Those in power know that and see this as unacceptable. Edward Snowden has pointed out that BitCoin is not as safe as everyone believes. He said:

“Obviously, Bitcoin by itself is flawed. The protocol has a lot of weaknesses and transaction sides and a lot of weaknesses that structurally make it vulnerable to people who are trying to own 50 percent of the network and so on and so forth.” … “Focusing too much on bitcoin, I think is a mistake. The real solution is again, how do we get to a point where you don’t have to have a direct link between your identity all of the time? You have personas. You have tokens that authenticate each person and when you want to be able to interact with people as your persona in your true name, you can do so.”

Zcash is far better than BitCoin for to remain equally interchangeable, units of Zcash are unlinked from their history so that one unit is as good as any other unit and this makes them really fungible in the to cryptocurrency world. They have unlinked shielded coins from their history on the blockchain. This means they can be used for tax avoidance and the government can use its Terrorist Card. They will not allow cryptocurrency to defeat taxes and BitCoin is not secure enough in that manner.

The rise in cryptocurrency has another side to it that is not being mentioned. Many of the people cheering BitCoin, are the dollar-haters who also tend to be the goldbugs. The interesting question that arises from this is very blunt. Has the introduction of cryptocurrency been displacing gold as the alternative currency?

This is a subject that requires a lot more space for analysis than a blog post. We also have central banks looking at creating their own cryptocurrency and that raises the possibility that private cryptocurrency will be banned.

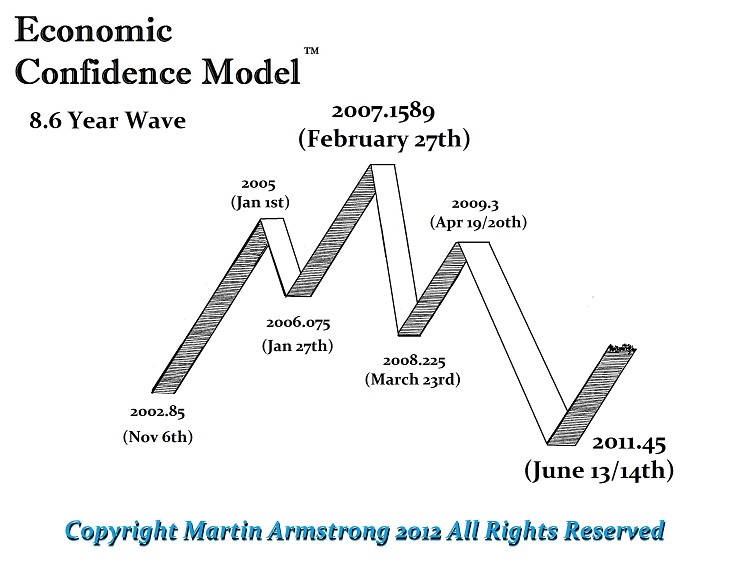

There is absolutely no question that we are heading into a new Monetary System. The Monetary Crisis Cycle turns up next year. We saw what happened as soon as the ECMpeaked in 2007 and we forecast new highs in the Dow back in 2010 (See Barrons), the War Cycle turned up in 2014 and our Political Cyclethat pinpointed the political change in 2016 produced Trump, the ECM peak in 2015.75 marked the day of the Russian invasion of Syria that began the Refugee Crisis in Europe, our Models of Britain forecast BREXIT, and those onCatalonia forecast the separatist movement would rise 2 years in advance – just to mention a few.

There is absolutely no question that we are heading into a new Monetary System. The Monetary Crisis Cycle turns up next year. We saw what happened as soon as the ECMpeaked in 2007 and we forecast new highs in the Dow back in 2010 (See Barrons), the War Cycle turned up in 2014 and our Political Cyclethat pinpointed the political change in 2016 produced Trump, the ECM peak in 2015.75 marked the day of the Russian invasion of Syria that began the Refugee Crisis in Europe, our Models of Britain forecast BREXIT, and those onCatalonia forecast the separatist movement would rise 2 years in advance – just to mention a few.

We will issue a special report on the coming One World Currency. There is just too much to address in a blog post and this will be food for thought as we move forward through the end of this current cycle wave on the ECM

No comments:

Post a Comment