Will Inflation Return to the Eurozone?

Posted Aug 18, 2018 by Martin Armstrong

There are three distinct types of inflation – Demand, Asset & Currency. The major type of inflation that everyone assumes is DEMAND. This unfolds when there is actually an economic boom and people have confidence in the economy. Asset Inflation is when there is no real demand from the consumer but the asset values rise primarily from foreign investment. This is normally witnessed in real estate, stocks, and bonds. There is a subdivision of Asset Inflation that is concentrated to a single area such a food that is driven by a collapse in supply due to perhaps a drought or flooding. The third type is Currency Inflation. This is when the actual nominal value of assets do not change, but the currency fluctuation will attract or detract foreign investors because of the large fluctuation in the value of the currency on world markets.

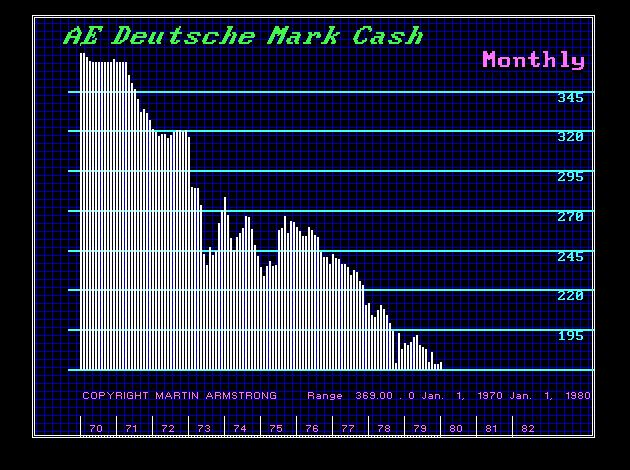

During the 1970s, I always bought German cars. A Porsche in 1970 was about $12,000 and by 1980 it was $50,000. The rise was really created by the decline in the dollar which created the perception that German cars would so well built, they would appreciate. I would drive one for 2-years and sell it used for a profit. This was the net result of CURRENCY INFLATION. As the Euro declines, we will see inflation in the Eurozone rise sharply. The ECB will proclaim victory after 10 years, but this has nothing to do with Quantitative Easing

No comments:

Post a Comment