Posted Mar 15, 2020 by Martin Armstrong

The Federal Reserve will return to its origin and it will do what it was originally designed to do. They will lend now on commercial paper rather than just government. As everyone knows, this has been my strongest recommendation and criticism of Quantitative Easing. The Fed was originally designed to create Elastic Money buying corporate paper to prevent a recession and job losses. World War I saw government interfere and directed the Fed should be buying government debt.

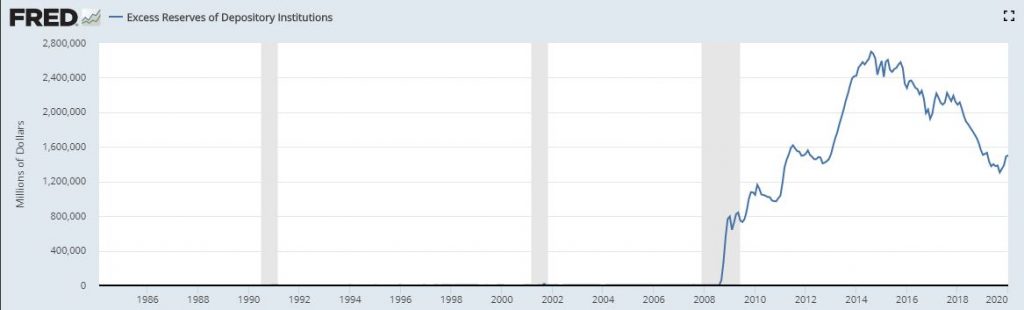

Injecting cash into the banks FAILED because the banks lacked the confidence to lend money. They turned and placed money at the Fed in Excess Reserves. Not that that bottomed in September 2019 with the Repo Crisis and is back on the rise again as banks are not lending.

Lowering rates FAILED because people will not borrow if they lack confidence in the future, Hence, Europe and Japan have destroyed their government bond markets and now they talk about nationalizing companies and eliminating paper money while seizing cryptocurrencies. They have no monetary power left in the central bank. All they can do now is turn draconian and seal the fate of their economic future.

The Fed will take a different path and lend directly to corporations because the bankers will hoard the cash and NEVER help the economy. This has been my #1 recommendation to save the economy and the central bank.

This is the REAL Crisis – not the coronavirus which has been at best the catalyst to set everything in motion for the monetary crisis and the Mother of All Financial Crises.

No comments:

Post a Comment