Up – Down – Sideways? What is Going On?

Posted May 18, 2016 by Martin Armstrong

Of course the markets have been causing losses among the bulls as well as the bears. This is what they do and MUST do before they can actually make a decisive move of the nature we are looking at ahead. It becomes rather amusing to what the so called professions end up constantly wrong so they start bruding and proclaiming this feels like 2000 or 2007 before the crash. Nevertheless, our proprietary Golden Rule of the 3 Attempts (TM) is a very important tool to comprehend. (details will be at the Technical Training Course).

The 2000 high was a Phase Transition in the NASDAQ DOT.COM Bubble. When we look at the Dow, we still see a high, but it is more of a declining sideways pattern. There were three failed attempts to make new highs but each was lower than the previous in compliance with our Golden Rule of the 3 Attempts (TM). This by no means appears even similar to the current pattern.

When we compare this to the current pattern pictured here, we see that the third thrust broke through the channel and made a higher high. This is not showing long-term weakness.

Here is the 2007 high. Again we see our Golden Rule of the 3 Attempts (TM) to rally but each one was significantly lower with new lows each time. This patterns warned of C R A S H & WATERFALL EVENT was in motion.

Now, look at how a market knocks on the door three times before it breaks out. This is just one of our technical rules we call the Golden Rule of the 3 Attempts (TM). No doubt other analysts will quickly plagiarize this and call it their own and you will quickly see who is a real analyst and who is fake. Still, even the 1966 rally, which was the Mutual Fund Bubble, and the 1968 rally when Bretton Woods started to crack, were the initial attempts to reach 1,000. Then we had the 3 attempts which did exceed 1,000 before the breakout began with the beginning of this Private Wave.

So to those who keep yelling the market will crash to 10 cents on the dollar, all I can say is I suppose that means people will buy bonds at -10% interest rates just to park money? If what they are yelling is even possible, then interest rates must move lower and big money is willing to lost it all just to park money. I am sorry. I just do not understand such logic. This is normally the type of nonsense you get from people who want to pretend to be an analyst but have no experience in the field so they lack any comprehension of the moving parts.

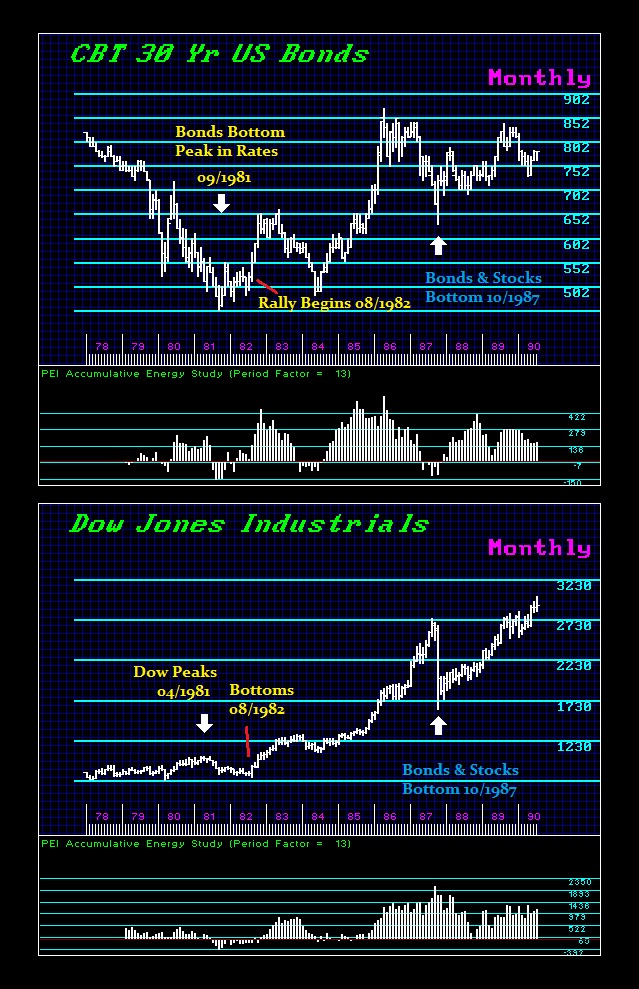

And as for the dire prognostications that the stock market will crash because the Fed will raise rates, this only once again demonstrates such people are not analysts at all for they have nothing original to add to the debate. I traded that rate hikes into 1981. With each rate hike the market declined true, then rebound. The final hike in 1981 the market rallied. It did not even decline.

So sure, we should expect the market will drop when the Fed raises rates. Fools will be easily separated from their money. This is why there are fools in the world. Every speciesis serves a purpose as energy in the food chain for the next one up in the food chain. Trading markets amounts to the same process. We always need the person on the opposite side.

Rising US rates will be inevitable. This will drive the dollar higher, fuel the debt meltdown, and when the capital inflows push US assets higher, the Fed will be compelled to raise rates further to stop the speculation because that is pure Keynesianism that does not work, but hey, what else do they have to do.

No comments:

Post a Comment