The Dow Down & Dirty

Posted Jan 31, 2018 by Martin Armstrong

COMMENT: OK Mr. Armstrong. Looks like the government was right. You come out and said the Dow reached a turning point and it crashes. You posted: “In the US Share Market, this is now a turning point we have reached. I have warned for months that exceeding the November high would lead to a January high.” You are too influential.

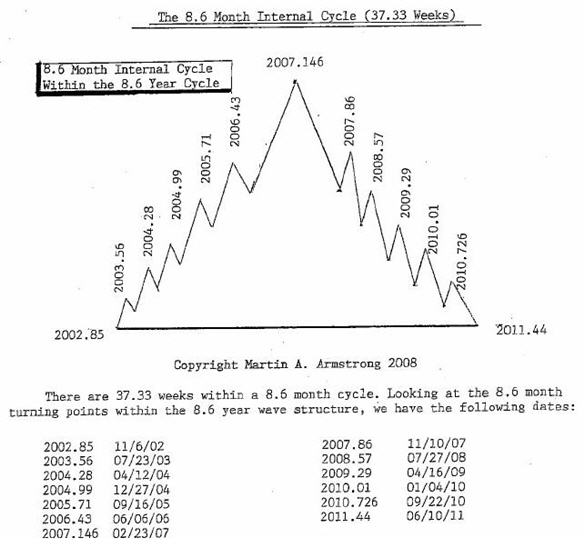

REPLY: Or perhaps our models are correct. This nonsense that people can move the market is absurd. Governments have spent trillions and failed. Why is it I am the only person who can move the world? Does a tree make a sound when it falls in a forest even when nobody is there to listen? They tried to silence me yet it still did not matter. Here is the internal 37.33 week. The target date 2007.86 was November 9th/10th. It was November 9th, 2007 that all four Daily Bearish Re4versals were elected from the major high.

So far, we have elected the first Daily Bearish Reversal. There are three more to go before we can say we are headed into a March low. Time will tell. It should be choppy for the next couple of weeks. When you gap lower like this, you normally will bounce and eventually fill that gap. So caution is always advisable.

The first high was the precise day that the Real Estate market peaked. They called that Armstrong’s Revenge on the trading floor that day. That was again precisely to the day and that same calculation produced the very day of the low during the 1987 Crash. Markets peak and bottom in sync with our models around the world even when I do not mention them. Sorry – there is just something beyond the surface that warrants our attention. These dates are not random. They cannot be fudged

No comments:

Post a Comment