QUESTION: Thanks for the latest posts.I have 3 queries if you care to consider them.

Some years ago you used to say $5000 and $12000 when contemplating gold’s upside.Now the latter seems out of reach.Can you indicate what caused you to

change your mind?

Secondly,regarding a possible Republican Presidential victory, does this correlate with a USD high and,if so,why?

Lastly,is a gold:silver ratio of 100 a possibility? (I have mislaid that portion of the 2014 Report which covers this topic).

Many thanks & Best Rgrds

Bill

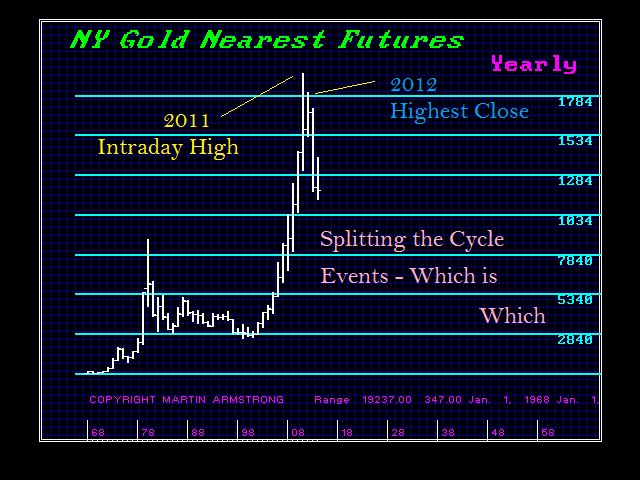

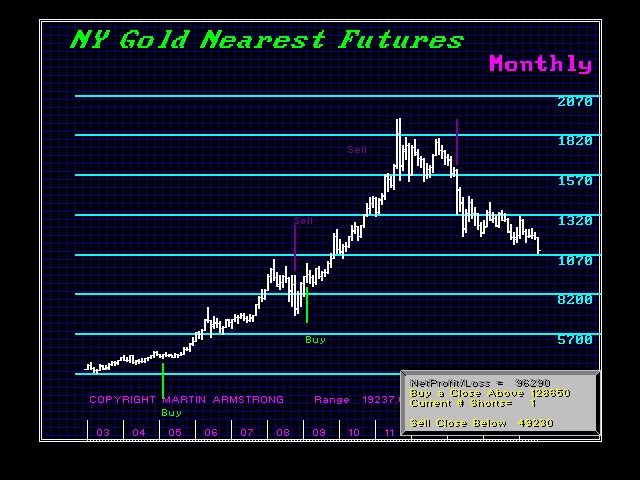

ANSWER: No $5,000 is still the technical max based upon the patterns we have so far. Yes, that could change when the final low is in place. That depends upon the downward thrust and how steep for the steeper the decline, the greater the projection out of that low will materialize. The $2300 target is minimum whereas the $5,000 is technical target – not based upon reversals and it is independent of TIME..

We need the low to see if that projection will change from $5,000. I do not expect this target to rise above $5,000, but that is entirely possible, although certainly not beyond $12,000 which is the most extreme possibility and probably never attainable. Such a level at $12,000 appears very unlikely because the system would problem implode before that would ever develop. If government still was in control, they would be going door to door at that point confiscating everything at gun-point.

The ultimate high all depends upon the patterns creating the low – not fundamentals. Nobody in their right mind will ever step up and buy the low. So it does not matter if demand for physical coins rises or falls. That will never be enough to make the low and is more propaganda disconnected from the events in all other markets. Nobody ever tries to catch a falling knife. We need the final low before the COMPUTER will provide that target rather than my opinion.

We have been the highest paid firm in the world for decades. Clients want to know what the COMPUTER is forecasting, not my personal opinion. So I could be wrong. I find it primitive when people try to criticize me personally for it only shows their own ignorance. My opinion does not matter. I cannot wait for the day to retire and let them all argue against the COMPUTER. It becomes like politicians claiming vote for me because I lie less than my opponent. They remain trapped in a primitive world and cannot see the global connections. NOBODY can forecast the future based upon fundamentals and personal perspectives. That is in the category of a witch-doctor. We need the COMPUTER to remove the bias and prejudice. It is what it is – nothing more. You cannot be an analyst and married to a predetermined view regardless of what the instrument might be. Everything rises, falls and rises again with TIME.

When the low comes into place, then the COMPUTER will provide the projection for the high. We will have to see what comes out. The $5,000 number was exactly what I have been saying all along. That is a projection based upon technical analysis ONLY. It is not the COMPUTER forecast since we first have to achieve the low.

As far as a Republican victory, it is independent of a dollar high. We are looking at a meltdown regardless of who wins. The dollar high is simply as I have been warning that the debt crisis begins in Europe and then manifests in Japan, and finally it hits the USA last. This is even how it unfolded for the 1930s. The USA has the biggest federal debt, but the taxes are lower than Europe. The disposable income in Europe is far less than in the States so there is less room for government to keep up this insane austerity that only support bond-holders,

We will provide the silver/gold ratio update for clients. That ratio has made wild swings from 120:1 intraday to 12:1. Despite what the promoters say, there is no “fair” value to which this ratio will remain constant. It will swing back and forth. Yes, we will pay attention to it for it will also help in looking for the turn.