QUESTION: Mr. Armstrong, it seems many people are starting to pretend they have artificial intelligence systems and neural nets. It seems that they are using these terms very loosely. Can you explain the real difference? Everyone I have spoken to says you are the father of AI in finance.

Thank you for all you contribute

Cheers

CW

ANSWER: Yes, 99% of what people pretend is Artificial Intelligence is nothing but an Expert System, which amounts to a look-up table. An Expert System is simply a list of, let’s say, diseases with their symptoms. You ask questions and it looks up predefined conclusions and says – wow, you have this disease. There is nothing to it. Real markets are nonlinear and the process by which they move appears to be random on the surface and that causes tremendous problems in modeling for if you cannot see the hidden patterns, you cannot achieve

Real Artificial Intelligence is something that learns and analyzes on its own to create its own conclusion. The countless claims of using AI to forecast markets can be distinguished rather easily from rule-based systems. You can take a chart, calculate the cycles, and then project the potential future pattern. Looks nice, but that is just making a calculation that can be done with a pocket calculator. There is nothing original in this process.

Then we have claims of using neural nets to predict the future. They can predict words and what you are looking for in Google or Apple’s Siri. Yet these are fairly rudimentary and far from the complexity of predicting the world economy. Neural Nets have outperformed subjective analysis like fundamentals. Nevertheless, attempts to forecast the future of markets has a dismal success rate of far less than 50% if not 33%. They have been flat models attempting to forecast a single market.

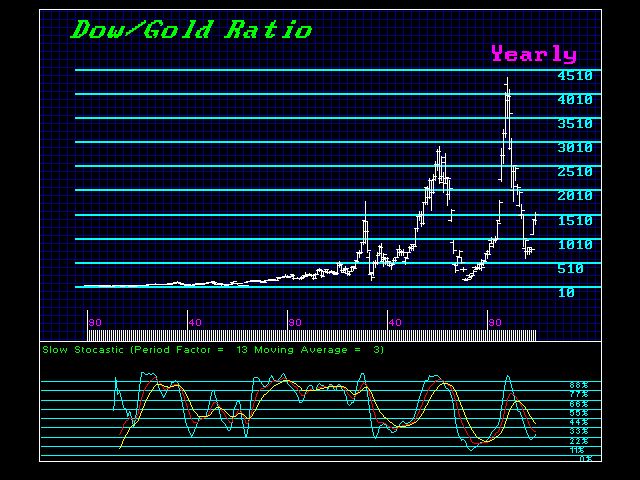

The problem with forecasting is human bias. This is the number one problem as to why forecasts fail. Take the goldbugs, they will never admit they were wrong even though gold declined for 19 years and this current decline is headed into a 5 year decline. They make excuses that are endless and will never revise their thought process. This is the human error caused by bias.

Then the next greatest failure in forecasting is attempting to predict the outcome of a single market in total isolation. Everything is connected. If you cannot grasp that concept then you are waiting in line to lose your shirt, pants, house, wife, kids, and the dog.

So how do we circumvent these two major problems? Devoted investigations, exploration of knowledge, and how it is attained in relation to the information process boils down to data processing in all systems of all kinds, regardless of whether we are talking about a human, animal, or machine based knowledge acquisition. True AI must acquire knowledge, remember that knowledge, and deploy it in the future without predetermined rules (e.g. if interest rates rise sell stocks) and without human bias. That creates an in-your-face confrontation with people clinging to their biases swearing you are evil and wrong.

So how do we circumvent these two major problems? Devoted investigations, exploration of knowledge, and how it is attained in relation to the information process boils down to data processing in all systems of all kinds, regardless of whether we are talking about a human, animal, or machine based knowledge acquisition. True AI must acquire knowledge, remember that knowledge, and deploy it in the future without predetermined rules (e.g. if interest rates rise sell stocks) and without human bias. That creates an in-your-face confrontation with people clinging to their biases swearing you are evil and wrong.

The true scope of the subject spans the entire range of interests from classical problems in the philosophy of the mind and psychology into issues in cognitive psychology and sociobiology. This involves the actual mental capabilities of a particular species. Ideas that are related to the Artificial Intelligence field and computer science reveal, not so much the answer of how to create AI, but how to distinguish what is NOT AI.

The primary emphasis is traditionally placed upon theoretical, conceptual, and epistemological aspects of acquiring knowledge. Then we turn to reasoning which many expect will emerge from that data set. This introduces a very fine line, which distinguishes problems that are empirical, experimental, and methodological over time. We need to employ imagination, but it must be tempered and controlled within reality. Otherwise, we can or cannot achieve our aspirations.

There are many aspects to Artificial Intelligence that distinguish both input and output. The output must reach something that, at the very least, matches the human ability to reason without the expert system structure of a predetermined result. Then the input must be broad enough to cope with humans in order to communicate. So there must be an ability to determine what you are feeding into the system as information to acquire knowledge and experience in order to comprehend the result reached. To achieve this, interaction must be comprehensible and that also requires introducing language to be able to communicate but the system must understand what words really mean.

You cannot accomplish these tasks with a simple downloadable program to pretend that you are employing Artificial Intelligence or have a program that makes billions of calculations and call that AI. These are concepts that by no means are easy tasks to create in programming code, no less comprehend. It has taken me my whole life to develop what we have achieved and there is nothing like this. You cannot even create a random number generator for in programming there is the simple fact that it will become too repetitive and thus unable to learn.

To accomplish real Artificial Intelligence, it was possible ONLY because I have the skill set as a programmer and the knowledge base of a trader. Without such a combination, that list of accomplishments becomes impossible and cannot be brought into focus. Programming is understanding how to read and write in many respects. That does not mean you can write a book on how it feels to give birth if you have never gone through such a process. The programming is the skill, but then whatever field you may be in provides the knowledge and experience that can then be captured in code.

What made this find so valuable was it contained legal code predating Hammurabi who academics teach was the first legal code. Here we have the Legal Code of (ca. 2100BC) which is

What made this find so valuable was it contained legal code predating Hammurabi who academics teach was the first legal code. Here we have the Legal Code of (ca. 2100BC) which is

socialism to the forefront in French politics. This shock wave has rippled through French society for decades ever since. Alain Geismar was one of the leaders of that time and characterized the uprising as “a social revolution, not as a political one.” (Erlanger, Steven.

socialism to the forefront in French politics. This shock wave has rippled through French society for decades ever since. Alain Geismar was one of the leaders of that time and characterized the uprising as “a social revolution, not as a political one.” (Erlanger, Steven.