Posted Feb 29, 2016 by Martin Armstrong

Obama stuffed Christine Largarde in the IMF and that has been far more devastating than any appointment to the Supreme Court. She has destroyed the global economy threatening countries to hand over info on everyone (except exempt politicians like her of course) so they can hunt money everywhere. They do not look at the net result, and only look at the world through their own eyes. I would hope Trump would look at this as a businessman and say you people are nuts.

Obama stuffed Christine Largarde in the IMF and that has been far more devastating than any appointment to the Supreme Court. She has destroyed the global economy threatening countries to hand over info on everyone (except exempt politicians like her of course) so they can hunt money everywhere. They do not look at the net result, and only look at the world through their own eyes. I would hope Trump would look at this as a businessman and say you people are nuts.

QUESTION: Mr. Armstrong; Why do you not advise Trump as Rubio and the Media demand details from him but from anyone else as to his economic plan?

CB

ANSWER: I do not advise Trump. If he really wanted to make an impact, he should watch the SOLUTION DVD. If he demonstrated that we need major reform or we are going broke, then he might attract more people who are on the fence. Let’s be realistic. Those supporting Trump distrust government politicians. They really do not care about his message. I at least would prefer Trump not for any policy, but any career politician will bring the same line of thinking to the table. There will be no thinking out of the box and we will be blasted with more regulation and taxes killing the economy.

Obama stuffed Christine Largarde in the IMF and that has been far more devastating than any appointment to the Supreme Court. She has destroyed the global economy threatening countries to hand over info on everyone (except exempt politicians like her of course) so they can hunt money everywhere. They do not look at the net result, and only look at the world through their own eyes. I would hope Trump would look at this as a businessman and say you people are nuts.

Obama stuffed Christine Largarde in the IMF and that has been far more devastating than any appointment to the Supreme Court. She has destroyed the global economy threatening countries to hand over info on everyone (except exempt politicians like her of course) so they can hunt money everywhere. They do not look at the net result, and only look at the world through their own eyes. I would hope Trump would look at this as a businessman and say you people are nuts.

The standard of living for families is declining. That is not because the “rich” are making more from investment, it is because of rising taxes and government robbing their savings to fund themselves and pretending they are there for their retirement. In reality, they keep lowering benefits because they stole all the money. Anyone in the private sector who did this would be in jail. We are prosecuted for fraud in the private sector, but fraud in public sector is rewarded and called “politics.”

What advice I would give Trump:

- We will not raise the minimum wage, we will eliminate payroll taxes and end the borrowing from the poor robbing them of interest by handing them a refund check so they think they are special

- Instead of QE for bankers, eliminate taxes and try QE for the people

- Eliminate Social Security for those under 50. Pay out those over 50. Replace Social Security with mandatory 401K investment plans

- Merge SEC & CFTC so advisers can provide advice on the best investment rather than just what they have a license for in equities v furtures

- Eliminate domestic corporate taxation. This will provide the incentive to bring jobs home

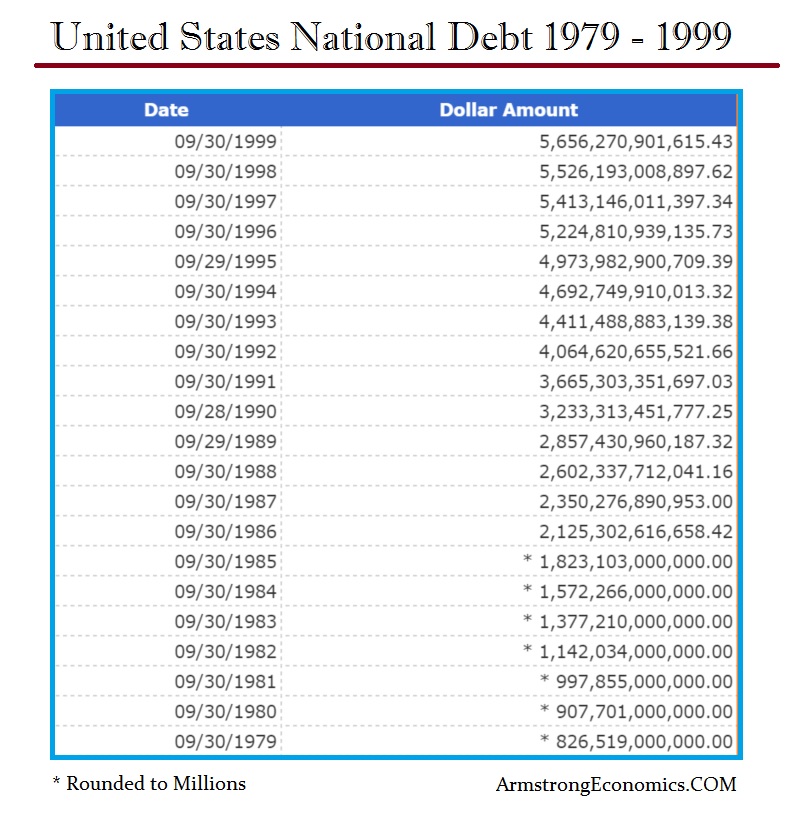

- Stop government borrowing. Limit the creation of new money to 5% of GDP (I do not want to hear that will be inflationary since QE failed to produce inflation which is all about confidence not the quantity of money). At times up to 70% of the national debt has been accumulated interest.

- Retire the national debt and stop competing with the private sector for capital

- Return the central bank to the original design of 1913. Eliminating government debt will do the job. During economic declines, the Fed should buy corporate short-term paper with its “elastic money” which will compensate for banks when the stop lending. Short-term corporate paper is actually paid off and that would then contract the money supply back to its original state prior to the crisis.

- Judicial reform is mandatory. I would retire ALL federal judges. Replacements should be nominated only by the legal profession with penalty to bribe and such appoint to be life imprisonment or death, the choice is that of the sentenced person.

- Expand the Supreme Court and make it an ABSOLUTE right to be heard rather than winning a lottery. Moreover, a panel of judges nominated by the legal community shall determine the constitutionality of ALL legislation BEFORE enacted. It should never be the burden of the citizen to PROVE the government is acting unconstitutionally. The Constitution is NEGATIVE and was intended to be a “restraint” upon government. ALL LIVES matter, and do this and they will.

- Reform the Grand Jury process. Both sides should be allowed to present ALL evidence to the Grand Jury and they alone will decide to indict. State prosecutors who protect police should themselves be in prison.

- Eliminate TSA at airports. You should be cleared as to who you are and no need for xrays and strip searches if you are known to be a normal citizen. If you are a foreign visitor, they alone should go through TSA.

- Eliminate all taxes whatsoever if you are not present to use such services.

- Eliminate all property taxes. You should be able to retire without having to cope with rising property taxes.

- No person should have to pay more than 15% of their salary to state and local government. If a government needs more, something is wrong and they need to be reformed.

- All government pensions must be eliminated. Part of the QE process should be the bailout of pension systems for government workers and end the process. If we eliminate taxation and social security, they will by law be required to save a portion in their own 401K

These are just for the start.

Britain entered the EU in 1973. Half the 8.6 year cycle is 4.3. It was lining up with our forecast back then that 2016 would be the first shot at a potential third party emerging or an anti-establishment trend. That forecast perhaps gained the most attention since we warned that Ross Perot 2.0 would be coming in 2016. Again, nobody can predict that it would be Donald Trump. It is not Donald Trump that is really the issue. It could be anyone. It is the timing that make such a message resonate with the population.

Britain entered the EU in 1973. Half the 8.6 year cycle is 4.3. It was lining up with our forecast back then that 2016 would be the first shot at a potential third party emerging or an anti-establishment trend. That forecast perhaps gained the most attention since we warned that Ross Perot 2.0 would be coming in 2016. Again, nobody can predict that it would be Donald Trump. It is not Donald Trump that is really the issue. It could be anyone. It is the timing that make such a message resonate with the population.