QUESTION: Marty; I had purchased your gold report and the low for gold came in exactly as you laid out on that benchmark date you gave more than two years in advance. But you are not saying you called the low of lows. I assume you remain skeptical about a reversal in trend long-term. Correct?

Thanks

KD

ANSWER: Correct. The low formed right on that target. However, while there is typically a counter-trend move between the Benchmark targets and even a cycle inversion as we saw on these Benchmarks at the 1980 high which the first one picked the all time high and the second the end of the first break, I would not be comfortable claiming we called the all time “low of lows” here for everything else is not lined up just yet. Yes, the low formed on the Benchmark we provided in that report (not on the blog for obvious reasons). The next convergence of the Benchmarks after 1980 came in 1983. That did not pinpoint the high, but the panic to the downside began right on that Benchmark and the low was then confirmed for a 19 year bear market.

Sure the typical goldbugs hate the dollar and only look domestically with a myopic view of often just gold, dollar, Dow and the Fed. It is hard to imagine that the dollar declines here when the USA is the only place safe right now to park money. This still appears to be a counter-trend move and nothing else. With governments dead broke and hunting money everywhere, the hyperinflationists seem to be smoking crack for they remain delusional. We are still in a massive deflationary spiral and 2017 it gets really bad with the G20 coming online where every country has to report on everything anyone has outside their own country.

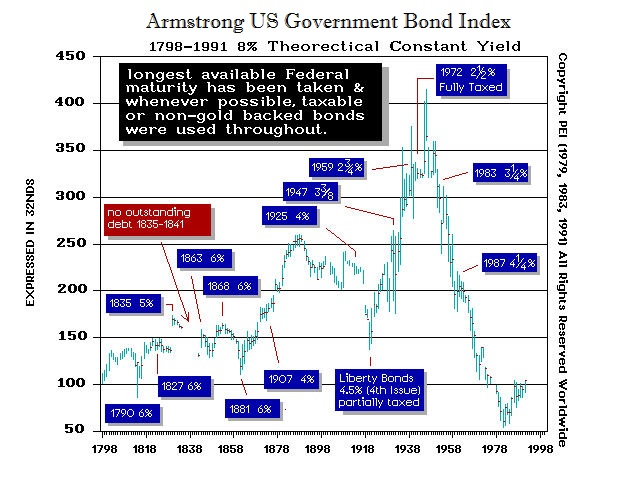

During the Sovereign Debt Crisis of the 1840s, you can see that government rates surged far above corporate. The Great Depression was massively deflationary because most of the world defaulted on its debt and that drove the dollar up and US rates to historic lows. We are looking more at the type of move of the 1840s where the the free market will turn away from government and pour into the private assets.

(the blue label marks which issue we began to use prior to maturity)

This is not going to end pretty. Yes, gold will rise along with most anything else other than government debt. Keep in mind one thing. You can take the stock market down even 90%, but that will never create a depression. If you take the bond market down which is generally 10:1 with respect to equities, just a 10% decline in value equals the same economic impact as taking the stock market down 90%.

Putting this all in perspective, we are not quite ready for prime time. I would not say we forecast the “low of lows” but just “a low” in this process right now. This was simply in line with the closing above 1044 for year-end and our call for the Euro to rally back to retest 116. The end of this fiscal tragedy is not too far away.

No comments:

Post a Comment