What set off yesterday’s big blitz to the upside? Two things...

..first, the Europeans seemed to be getting their act together. There’s a big headline in today’s Financial Times:

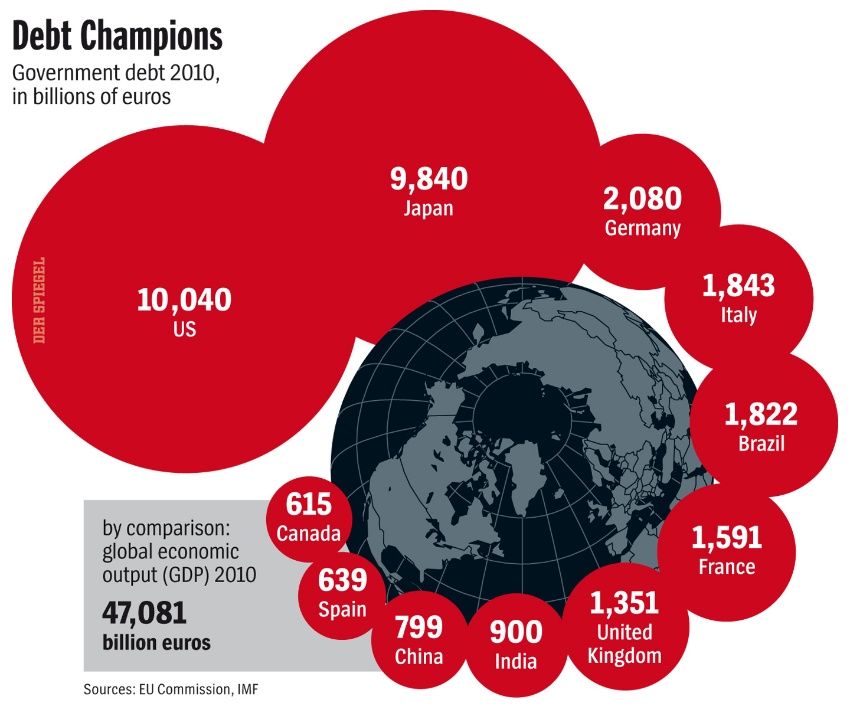

“China set to aid Europe bail-out.” The Chinese are looking at an investment of up to $100 billion in Europe’s stabilization fund. Details to follow...

The Greeks are to get another $130 billion of bailout funds. Details to follow...

Bondholders are going to go along with a 50% haircut. Details to follow...

And the EFSF (the stabilization fund) is to increase to $1 trillion or more. Details to follow...

The marching band set the pace yesterday. But in the parade of details to follow we wouldn’t be at all surprised to find a few sour notes. And we wouldn’t be at all surprised to find that investors sell their stocks when they hear them.

In resume, the Greeks can’t pay their bills because they don’t have enough money...which causes the Greek economy to go flat...reduces revenues to the government and makes it even harder for them to pay their bills. This problem will be overcome by borrowing from other Europeans, who can barely pay their bills either. And, thank the mischievous gods, China has come to the rescue too. China has real money...which it makes by selling products to the people who can’t pay their bills.

But investors are ready to believe anything. First, they thought they could borrow and spend their way to prosperity. Now, they think they can avoid the consequences of too much borrowing, by borrowing from each other.

We’ll keep an eye on it, dear reader, and let you know how it works out.

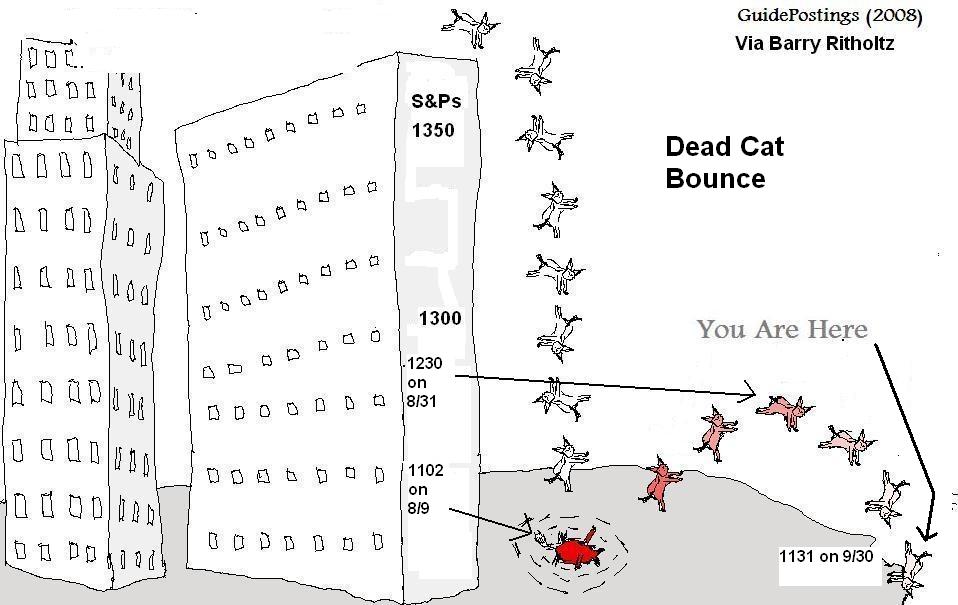

The other big news that set off yesterday’s rush to buy stocks came from the USA, where it was reported that the recession is off. That’s right, according to the feds the US economy grew at a 2.5% rate in the last quarter. Details to follow.

Says The Financial Times...the growth was “led by an encouraging jump in consumption.”

What is encouraging about that?

The report tells us that “consumption rose 2.4% at an annualized rate, adding 1.7 percentage points to growth.”

We also learn that “personal disposable income fell by 1.7%, annualized.”

How were people able to spend more when their disposable income and wealth were both going down? Good question. The answer is in the report too. The savings rate went down from 5.1% to 4.1%.

Now, let’s see... Households lost $800 billion of housing value over the last 12 months — or about $8,000 per family. Their incomes fell too. And the largest group of them is facing retirement sometime in the next 15 years, totally unprepared, financially.

So...you tell me that the economy is picking up speed thanks to their increased spending? And you tell me too that consumer sentiment — how consumers see their own situation — is at its lowest point in 40 years.

Our forecast: recession ahead...if not in 2011, in 2012.

And more on the General Theory of Zombieism:

When the financial crisis of 2008 hit, we saw how state-managed capitalism works. Favored companies are allowed to make as much money as they can. But they are protected from going broke.

Certain firms are deemed “too big to fail,” by virtue of the key role they play in the economy, or at least by the role they play in a politician’s plans for re-election or future employment. But state-managed capitalism is very different from the real thing. It is capitalism in a degenerate form.

Real capitalism progresses in fits and starts, described by Josef Schumpeter as “creative destruction.” It is like a jungle...not like a zoo. It cannot be managed. You cannot take out the predators or feed selected species without upsetting the balance of nature. Take out the destruction, and you block the creative process too. Since the beginning of the Industrial Revolution, most real wealth has come from real capitalism. Not from “playing the market.” Not from getting a good job. Not by trying to cadge favors from the government.

So, what is real capitalism? It is what we’ve seen in the computer/Internet industry over the last 20 years. This was a new industry. It had not yet been tamed by the government. Regulations were few. There were no large, entrenched companies to block start- ups. There were no lobbyists to curry favor from the politicians. There were no subsidies...and no barriers. It was young, dynamic, chaotic...and very prone to blow-ups.

The whole industry blew up in January 2000. Mistakes were not bailed out. They were corrected. Money moved from weak hands to strong ones. Many companies failed. The companies that survived, and prospered...went on to glory. Amazon. Google. Microsoft. Apple.

And who was behind these new companies? College drop-outs, computer nerds, products of teenage mothers and broken marriages. They did not enter the ranks of existing technology companies, work their way up to senior management and then create new product lines. It is almost as if they succeeded not because of advanced American capitalism, but in spite of it. They created an entirely new industry...with new companies nobody had ever heard of. And then, they destroyed some of the biggest businesses in America.

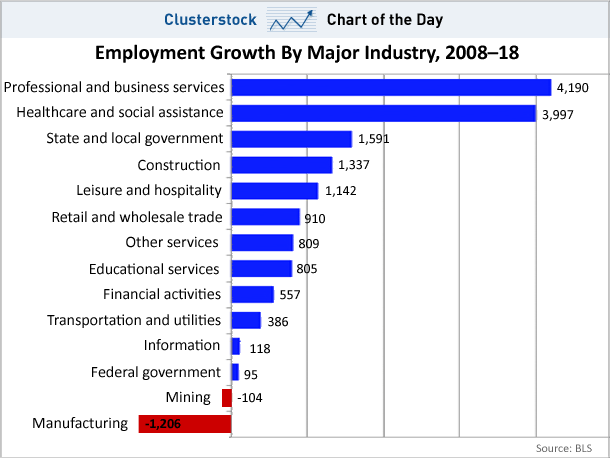

Typically, in a correction, asset prices fall and unemployment goes up. Misallocated resources — including labor — needs to be re-priced and put back to work. But when markets are not allowed to work the bid and ask spread in the labor market can stay out of whack for years. Joblessness becomes a structural problem, not a cyclical problem. People do not find new jobs. Old businesses are not swept away and new businesses do not start up.

A zoo economy keeps the old animals alive as long as possible.

Let’s look at education. Now, there’s an industry — we can all agree — that adds value. You could look at it as a charitable activity. Or as a profit-making business. Either way, education has to be a plus for the individual and for the society, right?

Wrong on both points. Education is only a benefit when freely floating prices are allowed to determine what it is worth. First, let us look at the whole industry. Since the 1960s spending on education, in raw terms, in per capita terms, in terms adjusted for inflation, has soared. From the 1930s, when the first careful records were compiled, to the 1990s, real spending on education multiplied 5 times per student. It more than doubled from the ’60s.

Did this increase in spending do any good? Not on the available evidence. Test scores — measuring achievement — have not budged in 40 years. In other words, the additional investment over the last 40 years has been wasted. We might as well have thrown the money down a well.

But while tests of achievement have not moved...the tests of potential achievement have improved. For whatever reason, IQ tests and SAT tests show young people are getting smarter...or better able to take the tests. This may seem like good news. But not when it is set alongside the performance tests. What we see is that the investment in education over the last 4 decades has actually had a negative return. The raw material was better able to learn. But the investment in the teaching industry produced less in the way of actual learning.

Today, the US stands out for its educational spending, as it does for the bombs it makes and the drugs it distributes — it is on the top of the heap, by a wide margin. Spending per school aged child in the US is about $8,000 per year. In Japan, it is half that. France is in-between with about $6,000 spent per child per year.

Which country has the best scores? The one that spends the least — Japan. On math tests, Americans score 474 (out of 600). The French do a little better at 495. And the Japanese get a score of 523.

Science, the same thing. US students get an average score of 489. Japanese students are at 531.

There is nothing very surprising about these figures. Nearly thirty years ago, American researchers found that there was no connection between spending and educational results. They just looked at different school districts in the US. Spending was not correlated with results, they concluded.

And yet, studies continue to show that people with more education do better in life. We doubt these studies have much validity, at least as interpreted. It is surely true that people with a lot of education have lower unemployment levels and higher incomes, statistically, than those with little formal schooling. But we have no way of knowing whether any individual student would have been better staying in school...or dropping out like Steve Jobs or Bill Gates.

But we will take a guess: the typical young person would be better off getting out in to the real world and learning as much as possible from working, than he would by staying in school. After all, that’s how almost all the world’s great geniuses, inventors, scholars, and entrepreneurs learned. It has only been in the last 100 years that public education has been ubiquitous...and only in the last half a century that ordinary people felt they should go to college. But as more people went to college, the less dynamic...less creative...and less productive the US economy became.

Our colleague, Gary Gibson puts it this way:

College is not necessary for most people. It never was. In fact, the preoccupation with college has left America bereft of its former ability to create wealth.

An unhealthy cultural myth has flourished that says everyone must go to college and get an advanced degree, even if it’s something for which there is virtually zero market demand. Meanwhile, below-market interest rates and government-backed loans have lured a couple generations of Americans down the road to higher education.

Further, the kind of education colleges provide — indeed, all of American schooling from kindergarten onward — doesn’t produce innovators, entrepreneurs and job creators.

In a recent article for The New York Times titled “Will Dropouts Save America?” Michael Ellsberg writes:

- “American academia is good at producing writers, literary critics and historians. It is also good at producing professionals with degrees. But we don’t have a shortage of lawyers and professors. America has a shortage of job creators. And the people who create jobs aren’t traditional professionals, but startup entrepreneurs.

- “No business in America — and therefore, no job creation — happens without someone buying something.”

Wealth is only created when value is added (You didn’t think it was when money was printed, did you?) The Austrian school of thought reminds us that value is subjective. People, ultimately, buy what’s worth buying to them with the money they’ve earned.

We cannot put too fine a point on this. It doesn’t matter what the seller thinks the item is worth. It doesn’t matter how much time, energy and material went into making the product or service. You can waste a lot of time, energy and material producing something no one will want to buy. The buyer determines the ultimate value...and whether he will part with his money for it.

There can be misallocations of resources. And when the central bank and government get involved, these allocations can grow very large and go on for a very long time before violently correcting.

So it is that, increasingly over the past couple of generations, there has been a gross misallocation of time and resources into higher education, aided and abetted by the central bank and the federal government.

Millions have been misled into pouring their young adulthood into endeavors that won’t pay off...and going deeply into debt for it. The federal government has encouraged this higher “education,” much like it did home “ownership.” The central bank made the borrowing easy with low interest rates — which powered the real estate bubble as well as the higher education bubble — while government entities backed the loans.

Now the education bubble is bursting. The bubble’s start can be traced to the GI Bill, whereby the government got into the business of shoving more people into college than the market would bear. Over time, the same easy loans and guarantees got extended to most of the population.

Over time, some bad notions gained traction. College came to be seen as the ticket to the good life as opposed to something that people already destined for greater things might undertake to help get them there. As often happens, causation became confused with correlation.

In the last 30 years, higher education has come to be viewed as a human right, something that governments are obliged to guarantee. Lost is the notion that a higher education is a path for the exceptional, particularly those exceptional people going into the hard sciences.

Of course, this doesn’t do anything to change the essential ability of the people now being shoved through the system. All it’s done is water down the quality of what’s being offered so that everyone can join in.

Exceptional people still become scientists and engineers. Everyone else gets a master’s in some field that was recently invented to meet the artificial demand for advanced degrees, for people who couldn’t be scientists or engineers, but who had a head full of misguided notions and a boatload of borrowed money.

Worse, this “education” came to supplant things like entrepreneurship, initiative, the willingness to take risk, to accept and learn from failure. As Ellsberg says in his article:

“But most students learn nothing about sales in college; they are more likely to take a course on why sales (and capitalism) are evil.”

Indeed. We hate to keep turning to the Occupy movement, but it is full of the poster children for this. They came out on the other side of the system unemployable and in debt. They feel lost and angry, unable to think of life past the burden of their student loans. And many of them (not all) feel that “capitalism” is somehow to blame, that the world of profits is somehow divorced from the well-being of people.

It’s criminal when “profits” are doled out to banks and “too big to fail” businesses by the government, with money taken from the taxpayers. But what about the real profits — not stolen goods — in which entrepreneurs take risks and business people add value, when the profits are the reward for serving people’s needs?

So the bamboozled have taken to the street. They would like their student debts to be wiped out, that “the people” be bailed out like the bankers and crony big businesses were. Or even worse, they get it in their heads that all higher education, henceforth, should be paid for by the government. It doesn’t matter whether there is a market demand for expertise in a course of study or not.

A system has grown up that encouraged enormous debt for nonperforming assets, namely, schooling in things that won’t pay off. People are still falling for it. But markets aren’t mocked forever. There has to be some painful write-down in central bank- distorted asset values before the economy can regain solid footing. This is just as true for higher education as it is for real estate.

It won’t be pretty. We’re not sure how this will play out for those who’ve misallocated their time and energy based on false signals, and with nothing but debt to show for it. But the stories that we told ourselves about what’s valuable were built on distortions that are now coming to an end.

Reality is asserting itself. And the reality is that entrepreneurship is what drives wealth creation, not going into debt to be taught that wealth creation is secondary to cultural studies or worse, that wealth creation is downright evil. The education industry has been corrupted by too much easy money. It is now zombified. Sclerotic. And parasitic. It now subtracts value. It takes valuable resources...not the least of which are the minds and bodies of people at their most energetic stage in life...and squanders them, making us all poorer.

Still, parents are terrified of the idea that their children may not get the “education that they need” and may be condemned forever to the lower rungs of the socio-economic ladder. The unemployment rate for college graduates, for example, is only half that of the rate for the rest of the population — less than 5%, even in the high- unemployment slump since 2008. Parents are afraid an uneducated child will not only be a failure, but will be forced by joblessness and poverty to move back in with mom and dad.

Yes, they will tell you, a degree from a Podunk University in the Midwest maybe be worthless. But get a degree from Harvard or Yale and you are on the train to status and prosperity. They are prepared to mortgage the house...and take out hundreds of thousands in student loans to buy the kid a ticket.

And they may be right. But only because the whole society has been corrupted by the same zombie virus. It has shifted the economy from one that cares if you can produce...to one that cares if your papers are in order. A small businessman will not particularly care if you have a college degree or not. He only cares if you can do the job. But big government and the big businesses it manages are different. They use education as a qualifier. Anyone who can sit still in class for 16 years — without questioning the nonsense that passes for knowledge — is a good candidate for bureaucracy.

What have been the growth industries of the last 10 years? Government is the main one. Obviously, government doesn’t care if you can produce or not. Who’s measuring? Its output is un-priced. Who’s to know if you handled your paperwork well...or made the right decision? Likewise, in the education industry, who’s to know if you are productive? What does it mean to be productive? Imagine that you have a job at a major university. You are an assistant director of its Local Community Outreach Program...or its Special Gender Enabling Group...or even its Career Placement Office. Who’s to know...or care...if you are doing a good job? All you have to do is to look and act in a presentable professional way. The rest is BS.

In the absence of any market-based test, you can get away with anything. All you need is a bright smile and a good line of talk. And a college degree, of course!

In non-market sectors, mistakes are eventually corrected, but only...like the Soviet Union...after decades of misery, and a final breakdown or revolution. In the meantime, the mistakes compound. The education industry takes more and more of the national resources while producing less and less real output. And if you want a job, you are better off as a well-credentialed zombie than as an energetic (often disruptive) producer.

But what if you were to start up a new business...a private school, with a clear profit-oriented, market priced output? With modern e- learning tools, you could reduce the cost of a real university education, to a fraction of the price people currently pay.

Mr. David Van Zandt of the New School in New York:

“I apologize to anyone here from Nebraska, but there is no reason to teach introductory chemistry in Nebraska in a classroom of 500 students. Not when you can pump in, say, someone from Harvard,” to give the lecture on video.

It is just a matter of time before the cushy, over-rich education industry meets destruction at the hands of new technology and new entrepreneurs. But don’t expect it to go gently into that good night. It has lobbyists by the score. It has money by the billions. It has its men and women in Washington...who will continue rewarding the failed, zombie schools, while regulating, squeezing out and crushing start-up competition.

That’s why, sometimes, it takes a revolution.

|