Iran on Schedule for the War Cycle

Posted Jun 21, 2019 by Martin Armstrong

COMMENT: Mr. Armstrong; I am a Muslim and I have just read you War Cycle report from 2015where you provide your forecast for this crisis we are cascading into. You historical analysis is fair and honest. Most people have no idea of the history of the region no less the divisions in Islam. Your forecast is coming into play. It looks like a countdown for the next year.

I wanted to take the time to express my respect for your world view and how you remain the voice of reason.

ABS

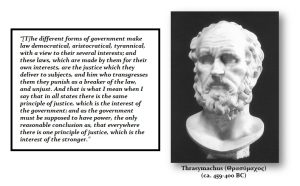

REPLY: I have been a student of history my whole life. But memorizing battles and dates and handing out titles like “The Great” (Magnus) for winning a war to me is the noise. The key to history is understand the patterns and once you see the patterns, it no longer justifies one position against another. I have come to understand Thrasymachus who observed that it did not matter what form of government we lived under, JUSTICE is always defined as the self-interest of government. Once I looked at his observation, it became crystal clear that it also did not apply to merely government, but all aspects of any group that seized power under a variety of labels including religion.

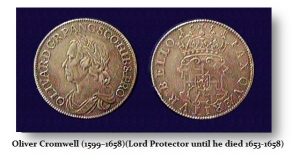

The English Civil War was also supposed to be about religion – Puritans v Catholics. Oliver Cromwell overthrew King Charles I and even beheaded him. He then issued coins calling himself the Lord Protector, but they carried his portrait with an olive wreath as if he too were then king. The Puritans outlawed all sports because that led to cursing, plays for they were lies, Christmas for you should be praying not celebrating, and it became a felony subject to death for kissing you wife in public. Indeed, Thrasymachus hit the nail on the head about 2,000 year before Cromwell – justice is simply the self-interest of those in power.

History repeats BECAUSE the patterns repeat and they are patterns of human reactions. I tried to do a good job in that report on the Middle East. The target date is rapidly approaching. Indeed, we have nearly a year to understand what is taking place.

Make no mistake about it. The majority of the youth in Iran do NOT support the current government in Iran. This also raises the stakes for the current religious regime in Ira will gradually lose power as attitudes change among the younger generations. To this inevitability, Iran becomes a greater risk for starting a war of they face the loss of power and a potential internal revolution. There was the 1979 revolution in Iran which put in place the religious government. The previous revolution took place between 1905 to 1911. It is unlikely that the religious government in Iran will be as strong after 2021 and the country is likely to end up with a completely non-religious government by 2051