The problem with gold has been the Gold Promoters who have made up sophistry to sell their product convincing so many people to lose everything they invest. While the hate mail has started again claiming I am “bashing the gold bugs” as if this were a sport for no reason, it sadly illustrates that some people will always go down with the ship because they are married to a concept and are unwilling to see the world for what it truly might be – complex and dynamic which defies their idea of what is money.

The

Associated Press says:

Investors are running out of reasons to own gold. The AP is a wholesale news agency so their story runs around the world in numerous newspapers. The AP summed it rather well:

The dollar has rallied in recent months, diminishing the allure of holding gold. The U.S. economy has been on firmer footing, and tumult in China’s markets and Greece’s debt crisis have failed to restore the metal’s appeal as a haven from global turmoil.

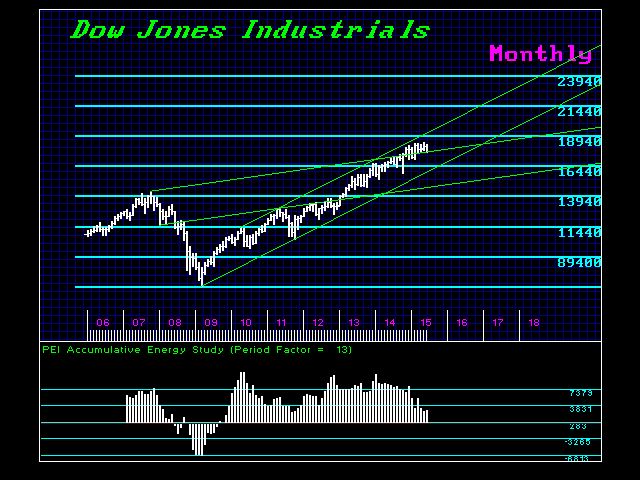

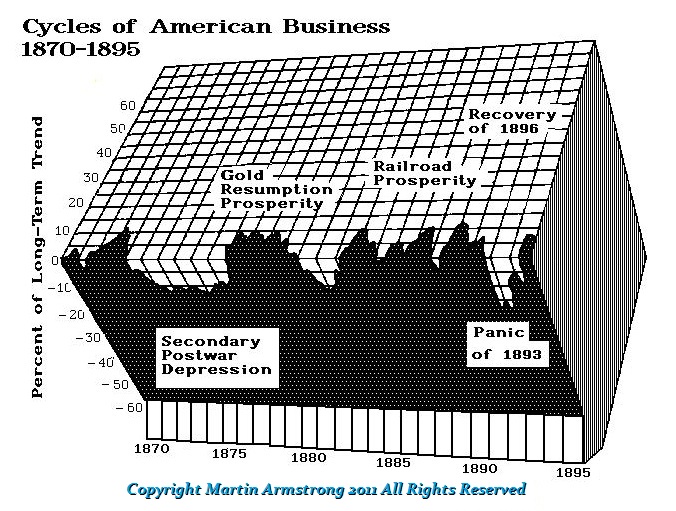

It is a shame they some just cannot see that gold had to decline and the dollar had to rise because of the fundamental unsound structure of the Euro and that this is just one piece of the puzzle as to how the world economy shifts from the West as it dies under the theories of Marxist socialism and moves to Asia for 2032. This is also deflation caused

- (1) by rising debt within government which propels higher taxation resulting in lower economic growth and government’s hunt for taxes is destroying the LIQUIDITY and global free-flow of capital.

- (2) the technology age of creative destruction is manifesting within the internet age whereas we are displacing the old with the new that requires less manual labor.

So as politicians try to force minimum wages higher, companies turn to robots and it becomes a deflationary spiral. Robots replace manual labor eliminating pensions and healthcare costs which have become the largest part of many business costs. Starbucks spends more on healthcare costs than of coffee. This is all part of DEFLATION measured not simply in prices, but is the decline of disposable income for prices will rise with cost-push inflation rather than demand-inflation that marks a boom.

Yet others have written realizing that just perhaps there might be something to this concept that everything is connected, which indeed forms much of the core of Asian philosophy.

“First, your insights and comprehensive knowledge have turned a light on for me with respect to how the world works. Thank you. I especially resonate with your fundamental given: that everything is connected, dependent on everything else. Yours is the first practical application of this fundamental insight of the mystics — especially the Eastern masters — that nothing and no one has an existence independent of everything and everyone else. The Vietnamese Buddhist teacher, Thich Nhat Hanh, coined a term for this: Interbeing. If only the would-be rulers of the world could understand this. Instead, they pursue their doomed dreams of the supremacy of Me and Mine over everything and everyone else, and so we all suffer — temporarily. Everything always changes…

Now a practical question: You mentioned benchmarks that you expect gold to reach on its trip down, but you haven’t mentioned what they are. I suspect that this information is contained in one of the special gold reports you have listed in your Store. Is this correct? …

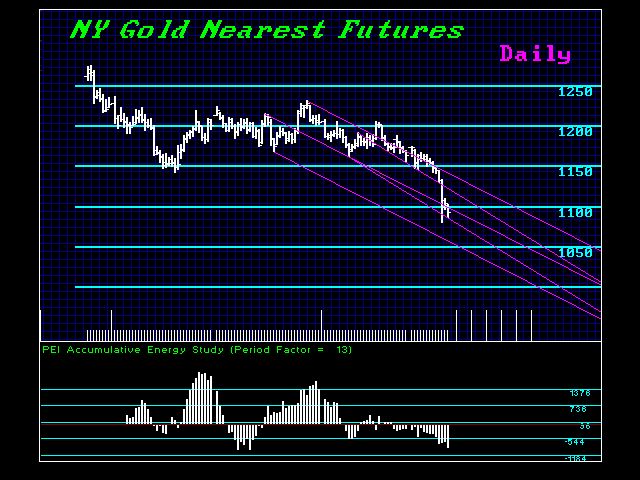

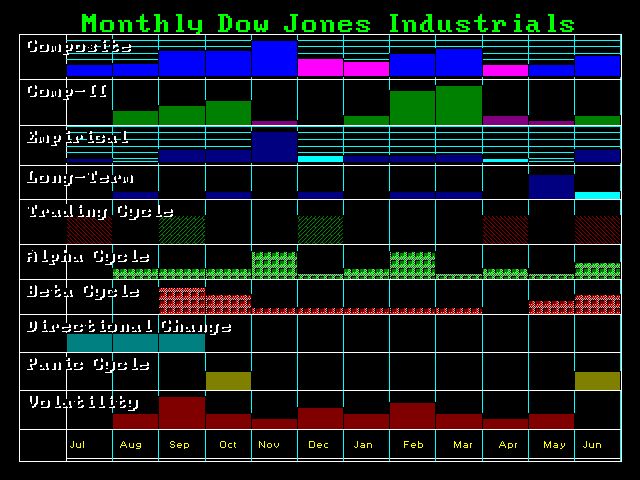

Yes, the Benchmarks are the targets for it is ALWAYS not just PRICE but it must also beTIME. These two objectives must be reached. So do we have the low yet? No. To create the low, the MAJORITY must turn bearish. Their target forecasts will be in the $600-$700 level. The key Weekly Bearish Reversals are 1084 and 1075 followed by 1042 and 1026. So we have four Weekly Bearish providing support before the break of of $1,000.

Even those who use Fibonacci retracements were looking at 1282, 885, and 243. All the fundamental sophistry of the Gold Promoters has amounted to propaganda if not outright fraud since typically they have have a business selling gold or are deeply invested in it and cannot see beyond their personal investment. Some are also more likely than not of the payroll of someone else to put out bogus analysis to trade against. They did that in the Dot.COM bubble as well.

I we hold 1084 for the weekly closing, then we can see a 2 week bounce and everyone will proclaim the low so hurry up and buy more. If we close below these numbers, then we can see a 2 week panic to the downside and a test of the 1980 high now. If that unfolds, then the latter target may be further down. So we play it by the numbers.

There is still a risk that the SECOND BENCHMARK will be the final low rather than the first. That would fit best on the yearly model and it appears that what comes after October 1st is going to be anything BUT normal. OPINION will not matter much for we are entering a period where only the computer will be able to cope with the future. Nobody alive has gone through what we are embarking upon – so OPINION won;t mean much.

The problem for gold in the future is the hunt for taxes may in fact eliminate it as a viable means to transporting wealth as it once provided over the centuries. You cannot legally store in a safe deposit vault, hop on a plane with it, or go buy a cup of coffee at Starbucks. The hunt for money may seriously impact gold as a medium of exchange except in a very black market reducing it to the modern day drug business.