QUESTION:

QUESTION: You say that long-term manipulations are impossible while short-term manipulations have been the focus of the bankers. Do you mean to say that not even governments can manipulate the economy perpetually? Are central banks buying US equities to manipulate the US stock market higher? It would seem that the Fed would then be accused of creating a bubble. What is going on?

Thank you.

PH

ANSWER: Ever since Marx, the Age of

“New Economics” as Volcker put it came to an end with the collapse of Bretton Woods and the Crash of 1974. Of course governments have tried to manipulate society and the economy. All governments operate out of their self-interest and they impose punishment as their weapon. They have falsified the statistics, revised them routinely especially CPI because they learned that everything was indexed to CPI so if you reduce the CPI you cut benefits without having to confront the people. After 1980, they removed real estate and replace it with rents using the argument that the former was investment not cost of living.

The entire game of manipulating society is to maintain their power. They historically will do whatever they need to do to achieve that goal. They routinely manipulate the truth using the press. Nobody will report that the Clintons not merely removed

ALL restraints against the banks from Intrastate Banking to Glass-Steagall, but they also made student loans non-dischargable in bankruptcy at the bankers’ request so they could securitize them. Nobody will bring that up about Hillary because she is the favorite of the press. They attack Ben Carson and Trump all the time but Hillary they assume is a coronation.

There is a

HUGE difference from claiming these private people or governments

CAN manipulate everything indefinitely and realizing that

no matter who they are they

CANNOT perpetually manipulate society or the economy. If the former is true, then there would be no crash and burn; just a flat-line. Sorry, people may not like that statement, but there is no proof that

ANYTHING has been perpetually suppressed indefinitely. Too many say markets are perpetually manipulated as if it were simply a fact, yet tell people to buy them anyhow. They cannot offer any proof that would stand up in a real court yet anyone who disagrees is evil and dangerous.

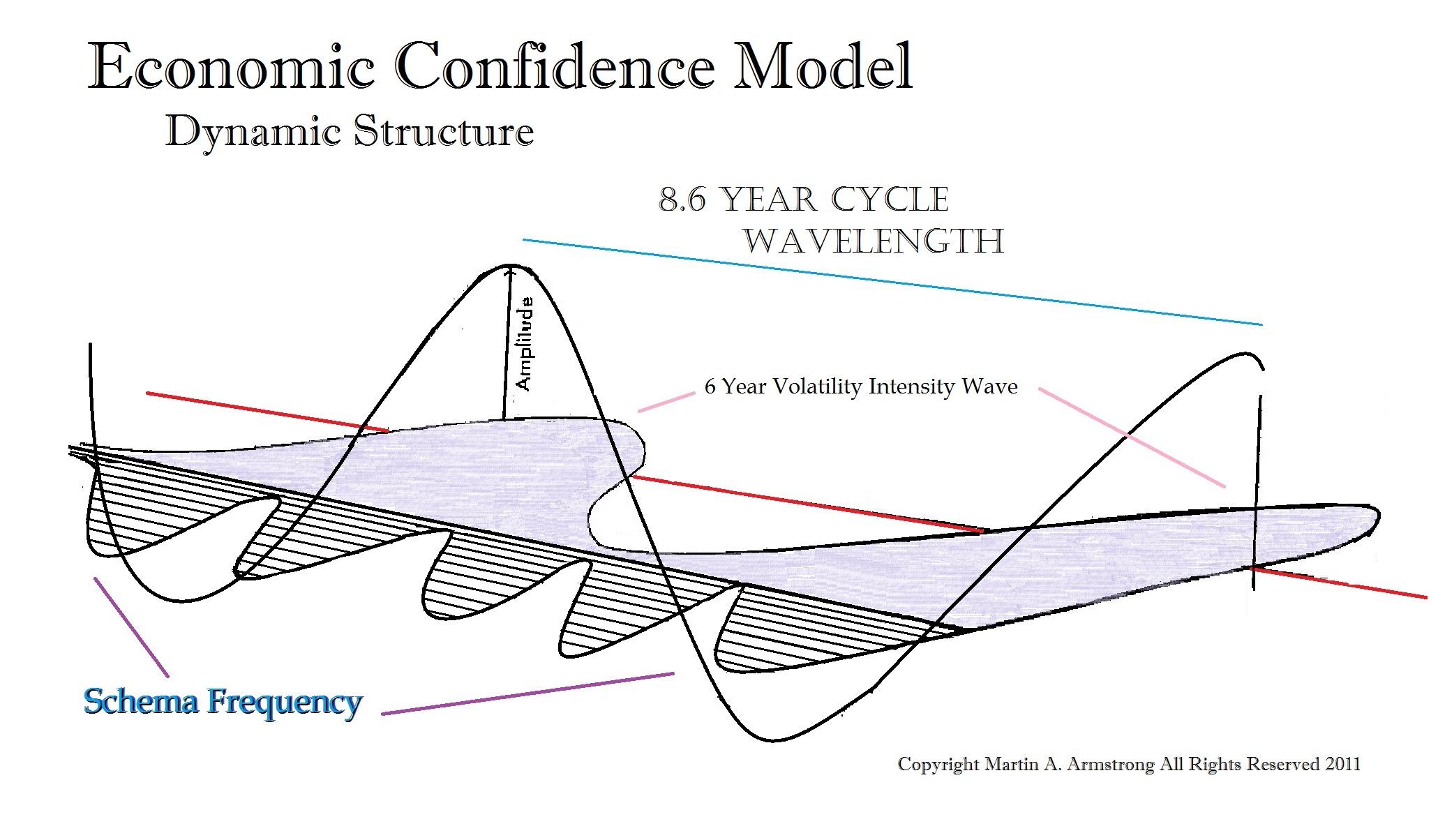

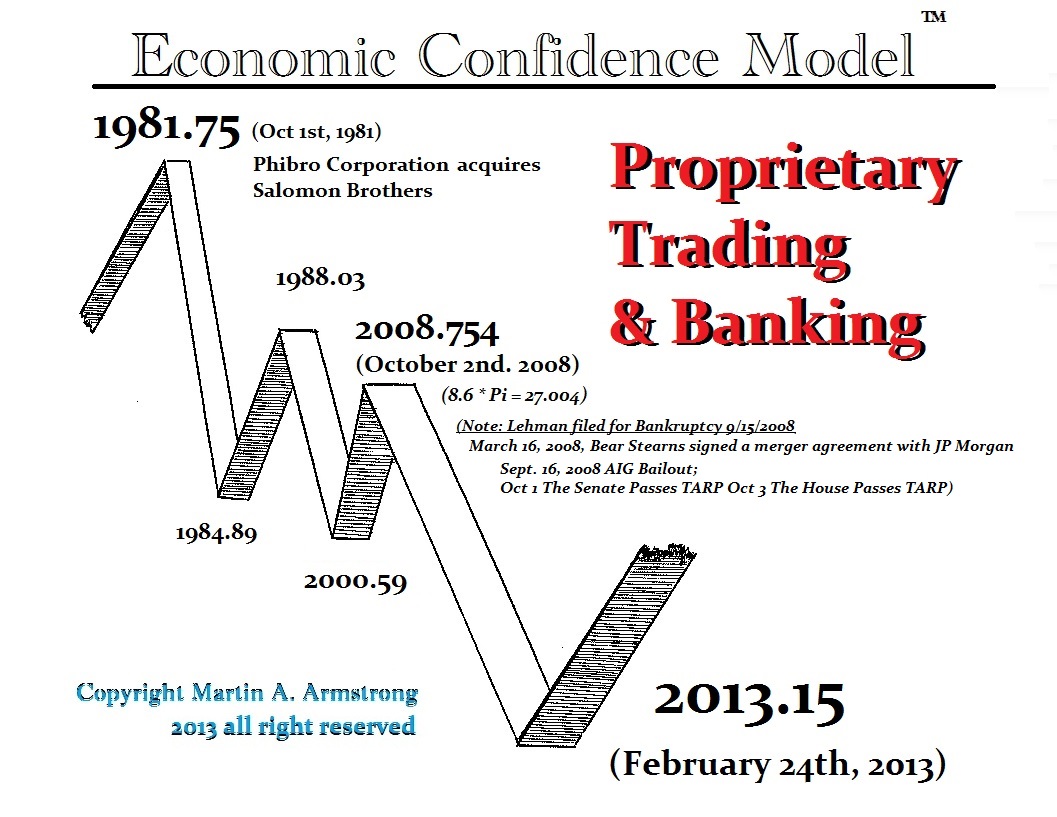

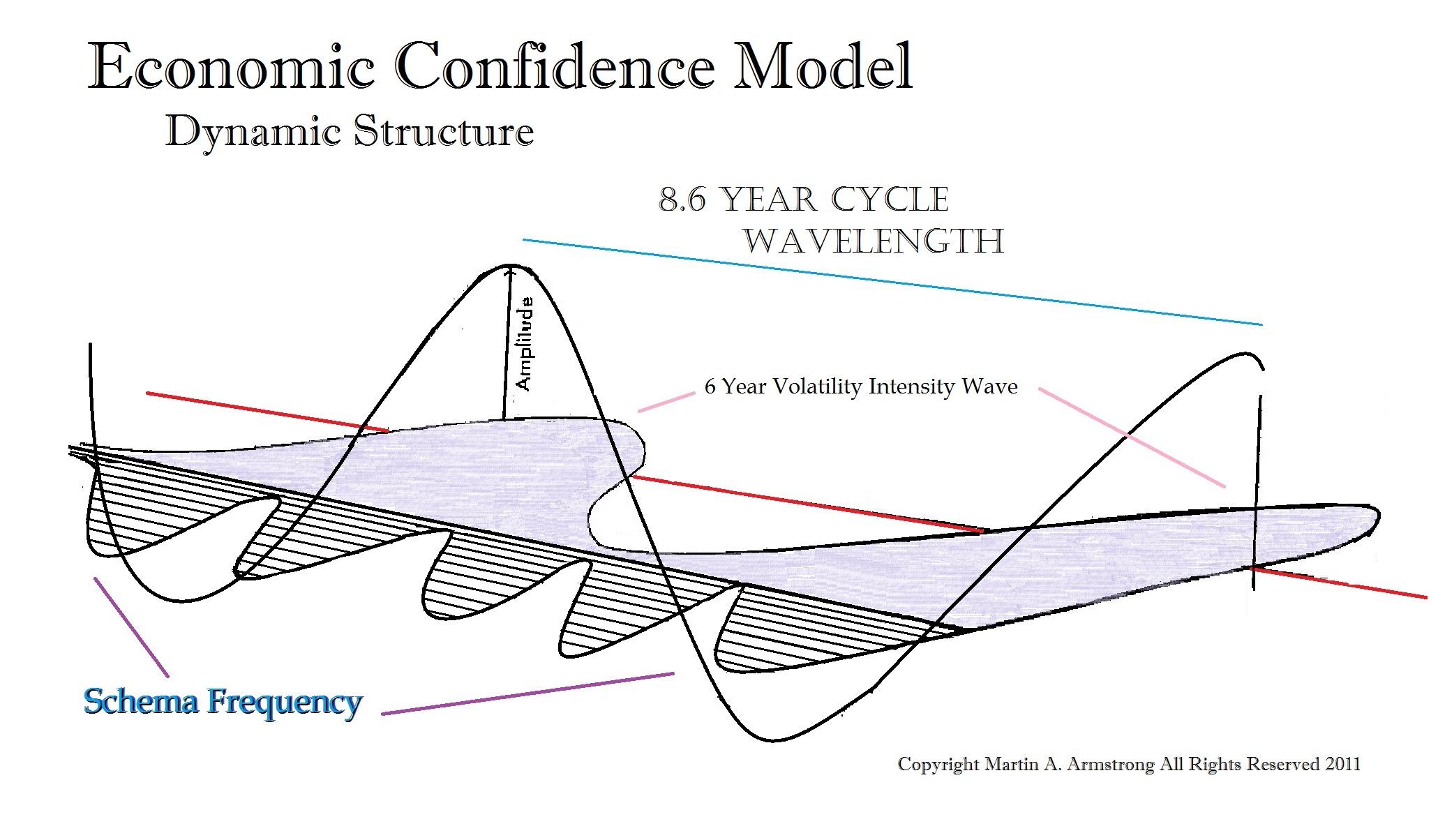

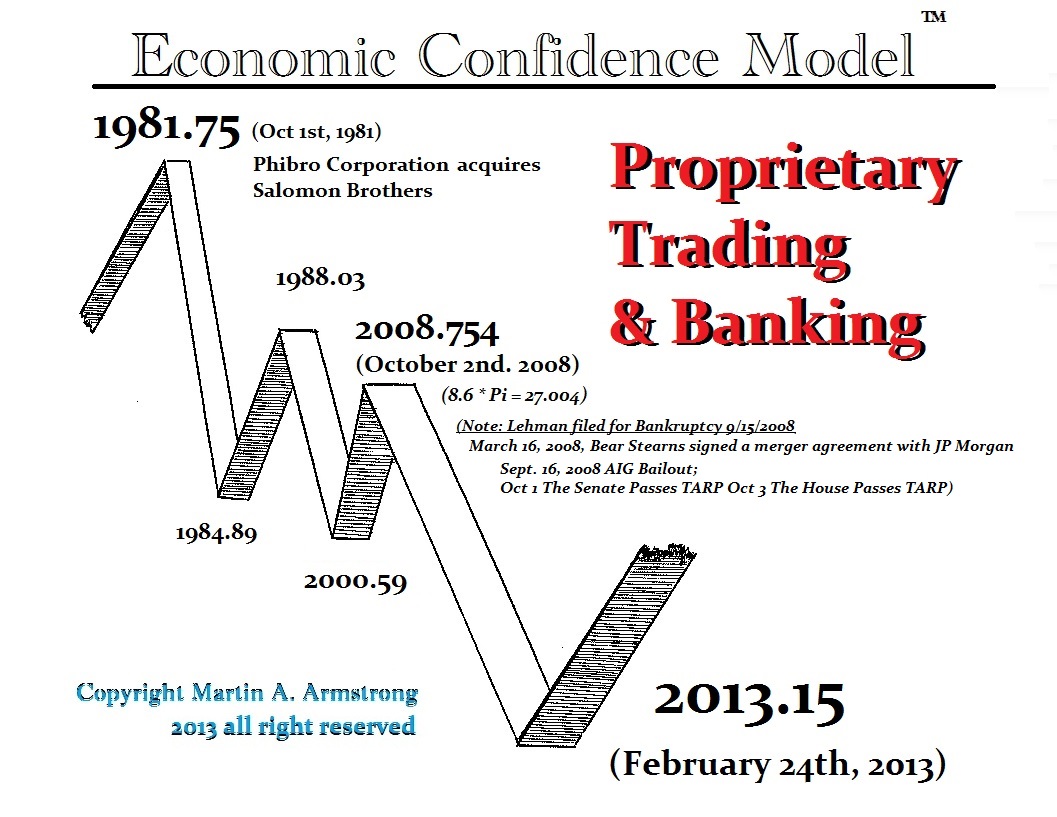

Society has been manipulated by government for typically 26 years (most common), 31 years (as Proprietary Trading), or the most extreme which follows the volatility models of 72 years (Communism). When it comes to the collapse of the monetary system (sovereign defaults) we are looking at 10 x the 8.6 which brings us to 86 years. So from the Roosevelt devaluation of the dollar in 1934, we should see the monetary system change in 2020. There are plenty of oscillations back and forth with each interval. Nothing is ever a straight line.

Society has been manipulated by government for typically 26 years (most common), 31 years (as Proprietary Trading), or the most extreme which follows the volatility models of 72 years (Communism). When it comes to the collapse of the monetary system (sovereign defaults) we are looking at 10 x the 8.6 which brings us to 86 years. So from the Roosevelt devaluation of the dollar in 1934, we should see the monetary system change in 2020. There are plenty of oscillations back and forth with each interval. Nothing is ever a straight line.

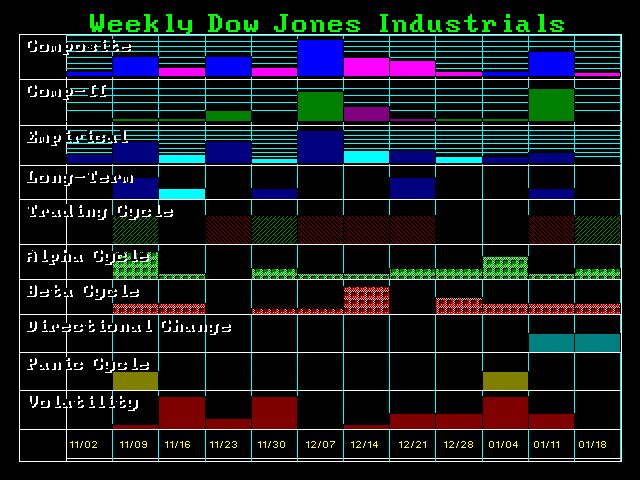

The era of bank manipulations (

Proprietary Trading) of numerous markets for

SHORT-TERM plays began in 1981 and came to an end in 2013. Nobody documented market manipulations as I did. This was a huge issue in court where they threatened to throw all my lawyers in prison unless they handed over those

tapes. So I find it ironic to claim I deny manipulations when they exaggerate everything to support their own failures.

The European banks have mostly withdrawn from manipulations while the “club” in New York are still active but their ranks are also diminishing. This will now lead to the further collapse in liquidity and that means much higher volatility.

If you cannot understand the difference, then you obviously do not have any real experience. Here is a

TAPED PHONE CALL which has survived on the silver manipulation before Buffett had to admit that he bought $1 billion in silver between myself and a dealer who was not part of the manipulation which was

ENTIRELY short-term and not perpetual..

It was on January 28th, 1998 a class action lawsuit was filed against the commodities firms that had been buying the silver. The lawsuit maintained the price of silver was being manipulated because the price of silver was rising as gold was going down, an “unprecedented” occurrence. With accusations that silver prices were being manipulated and a CFTC announcement that it was looking into the accusations,

Buffet’s Berkshire issued a press release on February 3rd, 1998 disclosing the purchase of $1 billion denying he was manipulating silver, yet silver still fell to new lows and the positions were sold. The professionals stepped aside. Who were the victims? Retail small investors as always who were sucked in by many of the same people. Ask them what their forecast was during this one. Where they a analyst and said

DON’T BUY its a manipulation or were they a cheer-leader as with every rally since 2011?

Even Bretton Woods, there was the

1960 crack, then 1963 (which resulted in removing silver from coinage in 1964), 1966, 1968 (two-tier gold market begins, and finally 1971 collapse. The Bretton Woods system was implement in 1945 when the IMF was born. What have I stated countless times?

The longest recession is 26 years. The Long Depression of the 19th century was 26 years starting with the Panic of 1873 concluding with the peak in interest rates in 1899.

Japan bubble peaked in 1989 and we should see a shift start next year as 2015 was 26 years down.

It does not appear historically that anything can be perpetually manipulated for the free market will always create the check and balance. There is no historical trend that anyone can point to. Even the

Latin Monetary Union of the 19th-century attempted to unify several European currencies into a single currency like the Euro but without the surrender of sovereignty. The currencies in 1865 were standardized so the same weight of a gold coin was interchangeable without requiring foreign exchange fees. This lasted for two Pi cycles totally 62 years, but there were some interruptions due to war. It was disbanded in 1927 and that was not a manipulation, just a monetary union trying to create a single European currency back then for trade.

Governments today are desperately trying to control everything from the press onward. This is the drive to create electronic money which is a final straw in their desperate manipulation to sustain power to force everyone into taxation.

The real

MANIPULATION is not to suppress a single market, it is to control society. That is the big game afoot. It is much bigger than simply trying to suppress gold. That accomplishes nothing. Gold is the

HEDGE AGAINST GOVERNMENT and that they know. This is why they are trying to track gold movement. We are approaching the TIME when the metals will reverse. That comes ONLY when the majority lose confidence in government. We can see the trend starting to prepare for that is why Trump is leading. It is not about him personally, it is about throwing out career politicians and we are seeing this as a global trend. When the

CONFIDENCE in government declines for the majority, that is when things go nuts. It has nothing to do with fiat, manipulations, bankers, or whatever. It is the collapse in confidence in government.

I have shown this chart on the collapse of the Roman Monetary System many times. The collapse takes place

AFTER the emperor Valerian I is captured by the Persians. Can you imagine the blow to confidence if Obama was captured by Putin and he turned him into his foot-stool and the US was powerless to invade? Then you would see the collapse in the dollar just as the Romans saw the collapse in their currency. It is

ALWAYS a confidence game.

As far as central banks buying US equities, no they are not manipulating the market. Interest rates are way too low and equities offer better return. But additionally, countries like Switzerland lost a fortune on the Euro peg in the area of

50 billion Swiss francs. The total population of Switzerland is just over 8 million. That means they lost 6200 francs per person or about $7,000 per person at the time.

The Euro is a failure. There is nothing left in the world for big money

BUT the dollar. So the lack of alternative reserves have forced central banks to buy equities. They are all

NOT creating money to buy equities out of thin air. Anyone who claims that is revealing their lack of international knowledge and are judging the world by the Fed, which has the power to create money as an

elastic money supply. I explained back in 2011 the

structural difference between the ECB and the Federal Reserve.

Anyone who claims all central banks have the same powers has not done their homework. Some buy US equities selling bonds and shifting assets

WITHOUT creating money. It is just not true that all central banks can create money elastically. However, many have now been given powers to create money to achieve Quantitative Easing, but it is not unlimited in many cases whereas the Federal Reserve does not require Congressional approval to buy more debt since it has the power to create elastic money from the beginning.

To carry out Quantitative Easing central banks create money by buying securities, such as government bonds, from banks, with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased—hence “quantitative” easing.

The Swiss National Bank (SNB) took a huge hit on its attempt to manipulate the currency market by creating the euro-franc peg. So if they lost money, how does this stack up if they can just print money at will? It would seem strange that they could ever lose under this scenario. The SNB had a huge loss on foreign exchange positions that were denominated in Euros. These Euro positions were bought in a desperate attempt to prevent the appreciation of the Swiss franc against the Euro for trade purposes.

However, the losses were partially offset by 10 billion in price gains on stocks and bonds in its portfolio like any other investor.

Contrary to this idea that all central banks are the same, here the SNB includes 236 million in its income derived from negative interest rates paid by depositors for holding deposits there at the central bank. This is a revenue source which the Fed can only dream of where the Fed pays 0.25% on excess reserves amounting to welfare for bankers.

Therefore, the huge loss on the peg is the result of mark-to-market accounting on assets rater than just showing original cost accounting as Japan did. In its published financial statements, the SNB is required by Swiss law to mark its investments to the current market price which includes both securities (stocks and bond holdings) and gold holdings.

This is strikingly different for the Federal Reserve is not mark-to-market. The SNB on March 31st posted a net worth of 56 billion chf, compared to its 581 billion in total assets yielding a 9.7% capital to-assets ratio, after the huge loss on the peg. The capitalization of the SNB is about 2% greater than the Federal Reserve, which is $58 billion.

Additionally, the Constitution of the Swiss Confederation required the SNB to hold part of its reserves in gold set at 7%. There was a Swiss goldbug referendum where about 78% of the people voted

against expanding central bank gold reserves to 20% from 7%. The SNB held 39 billion in gold, marked to market on which they have suffered a huge loss since 2011.

The Federal Reserve owns zero gold because in 1933, Roosevelt took the Fed’s gold, along with everybody else’s; something overlooked by the conspiracy generators. Moreover, shares of the SNB actually trade on the Swiss stock exchange with annual shareholder meetings. The Fed’s shares are held by key banks but they do not trade on any exchange.

The Fed’s balance sheet shows as of

August 2015, that the

“average daily balance of the Federal Reserve SOMA holdings was approximately $4.2 trillion during the first half of 2015. Net earnings from the portfolio were approximately $54.6 billion; most of the earnings were attributable to interest income on Treasury securities and federal agency and GSE MBS.” The Fed does not mark investments to market.

There is a

TIME and

PRICE where you sell and when you buy. That is the fundamental basis to everything. People who never say sell only buy and hold are dangerous for they do not take reality into consideration. But so are those who simply look at the Fed and

PRESUME all central banks operate the same. There are significant differences. The goldbugs hate me because I do not give people fake advise telling them to only buy and hold no matter what. They argue I was pro-gold before and turned against gold after. Sorry, it is called being an analyst. So they try to slander me because they are wrong. They have no

conscience when people lose everything. They show no remorse, just hatred toward me for calling it as it is. If you are a real analyst, you are supposed to

HELP people, not bury them or trade against them. Fake analysts and politicians share the same trait – neither can say they are ever wrong. It’s always the other guy’s fault.

Telling people to buy and hold and now saying gold will go to $100,000 is just wrong and it is the very propaganda the bankers want them to say to get people to buy from them at the top of every rally. That is not analysis, it is propaganda if not fraud. No real analyst gives one-sided advice for that means they are not doing the job of analysis. You personally attack someone (messenger) when you cannot rebut the message.

Gold will rally on schedule. The entire world economy functions because we are all connected. Arguing manipulation because you cannot see the trend as a whole is pretty pathetic. The free markets rule for that is Adam Smith’s

Invisible Hand. Even Communism fell after 72 years (1917-1989). They killed Kondratieff for making that statement that the cycle will prevail and no doubt they would love to kill me for the same reason. Those who now want to argue manipulation and there is no business cycle are taking the very same position as Stalin who had Kondratieff killed and Keynes who argued for government manipulation of society.

Sorry – the Business Cycle will

ALWAYS win even against the goldbugs when they try to defy its existence as did Marx, Keynes and Stalin. Nobody has ever defeated the Business Cycle even once. Gold will rally to new highs

only when everything is lined up. They will never admit that nor do they understand the global alignment because they only see everything through the eyes of metals and nothing else. An analyst does not lead people to the altar of the manipulators for slaughter.