Posted Feb 21, 2016 by Martin Armstrong

QUESTION:

Dear Martin ,

I had been following the the various gold bug theories since 2009 but became disillusioned after 2011 until I came across your site . What you say makes sense and something I trust , however there is still one issue I am struggling to understand . When gold spiked during the Great Depression and then also again 1980 , the ratio of gold to the Dow was almost 1:1 in both periods of history .However , this time , although gold bugs are forecasting this ratio to materialise again in the coming years , it would appear that you are not , in that gold may go to say US$ 5000 but the Dow to about US $ 35,000 ( 7:1 ) . What I am not clear about is that if Gold only increases when there is a loss of confidence in Government , did this not happen in 1930 and also 1980 ? Or are you saying that in 1930 and 1980 this was a loss in confidence of the private sector but in those days gold was a safe haven , hence the reason gold went up as the Dow went down and therefore because this time is a loss of confidence in the public sector we will not see the ratio of 1:1 as both gold and the Dow will go up ?

I really hope you can answer this point as I think it will really explain the big difference in how you are interpreting gold now compared to 1930 and 1980 ,

I have been following his prediction for the coming slingshot with great interest and would like to ask Martin if he feels that finally within the coming months it would be smart to move cash out of the banks and into large cap gold mining shares which must surely now be at or around the bottom . As Martin says , the low for gold may not be in just yet but in principle , once he feels this is the case would large cap miners be one of the best investments in his opinion ( given that many other shares are at least fairly or possibly over valued ) .

I have been following his prediction for the coming slingshot with great interest and would like to ask Martin if he feels that finally within the coming months it would be smart to move cash out of the banks and into large cap gold mining shares which must surely now be at or around the bottom . As Martin says , the low for gold may not be in just yet but in principle , once he feels this is the case would large cap miners be one of the best investments in his opinion ( given that many other shares are at least fairly or possibly over valued ) .

Many many thanks for all your outstanding work . So much appreciated and by so many ,

ANSWER: The problem with trying to create some sort of fixed ratio reveals the lack of understanding about markets and the global economy. This is typically the amateur approach to analysis which demonstrates more of the lack of experience about the analyst than anything else. This amateur approach to forecasting is why such people will never be taken serious by big money no less governments. They make connections that are as primitive as saying everyone who has ever eaten a carrot has eventually died and therefore carrots are lethal. It is a true statement, but the connection between death and a carrot is obviously very a very amateurish approach to analysis.

In this context, the fatal flaw is they try to create a similar one-dimensional relationship with the Dow, Inflation, or even the quantity of money. This is such a tiny slice of reality, it is seriously flawed. In medicine, they used the same approach and assumed all disease must be introduced to the body from some external source. Thus, smoking they linked to smoking. But there are people who have smoked like a forest fire their entire life and die without a trace of lung cancer. That simple fact proves the analysis is wrong. What DNA research has proven is if you have the gene for lung cancer, smoking may accelerate the event, but not smoking will still not change the outcome. This is really why when you see a doctor they ask you about your family history. If everyone died in your family or a stroke or heart attack, your genes may be carrying your own fate and the cause is not external.

For example. James Fixx (April 23, 1932 – July 20, 1984) was the American who authored the 1977 best-selling book The Complete Book of Running, which has been credited with starting the America’s fitness revolution. He popularized the sport of running claiming this would build your heart and prolong your life. Fixx has a family history of dying from heart attacks so in theory he came up with the idea that if you ran, you would build the muscle in your heart and that would defeat the disease. Fixx died of a heart attack while jogging at 52 years of age. It was a nice theory, but it did not overcome his family genetics.

So let’s begin with your assumption that gold rally in 1930 and also 1980 both times because people lost confidence in government. This was absolutely a FALSE statement. During the 1930s, the dollar RALLIED, it did not decline. Why? Because the collapse in confidence was external, not internal. Most of Europe defaulted on its sovereign debt, so did China, and South America as usual. As other countries defaulted, capital flowed into the dollar as the safe-haven. Gold actually declined and fell below the official gold standard value of $20.67, it did not rise it was the dollar and not gold which went to a premium. The jump in gold to $35 was Roosevelt’s FIAT devaluation of the dollar which was actually government declaring the value by decree.

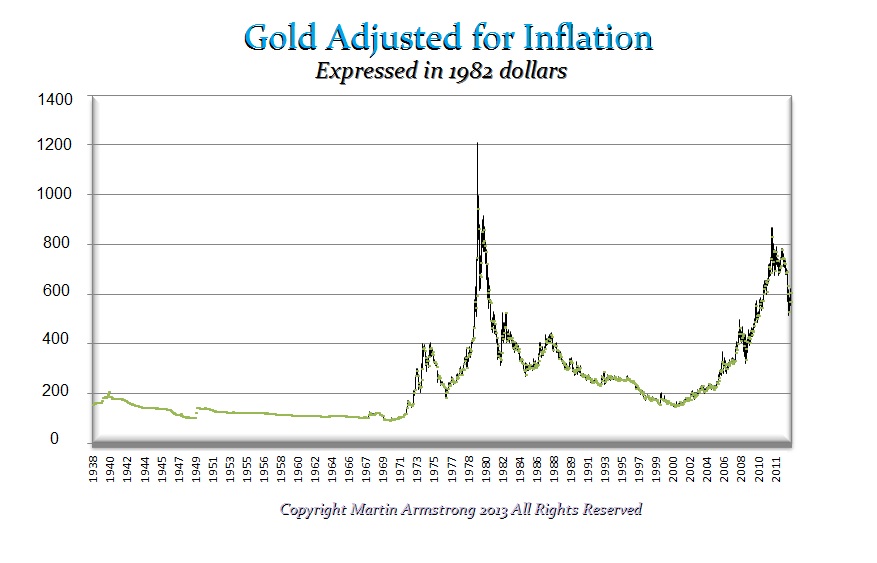

In contrast, the 1980 rally was completely different. Here it was the dollar in question for Nixon closed the gold window shutting down Bretton Woods in August 1971. So the decline in confidence concerned the dollar, not external countries. Yet here too we see interesting revelations that prove the idea that gold rises with with or the expansion in money supply is dead wrong – it is always a confidence game. The inflation of the 1970s was COST-PUSH rather than DEMAND-PUSH for the first half. It was the OPEC crisis which raised the price of oil so this set off an acceleration of “inflation” driven entirely by the rise in the cost of doing business. The net impact was DEFLATION following 1974 falling into 1976. Gold collapsed from nearly $200 to $100 despite the fact the the price of everything was rising. That increase in price eventually transformed consumers between 1976 going into 1980 into a DEMAND-PUSH inflation spiral whereby they realized it was cheaper to buy now than to wait since prices would rise. Volcker at the Fed responded by raising interest rates to try to stop the demand. He created such high interest rates that investors switched from tangible assets and stocks moving into fixed income. My mother and her sister went out and locked in 10 year certificate of deposits at 20% without even asking me. So this was entirely a different set of circumstances from the 1930s. So why should there be any connection between the Dow and gold?

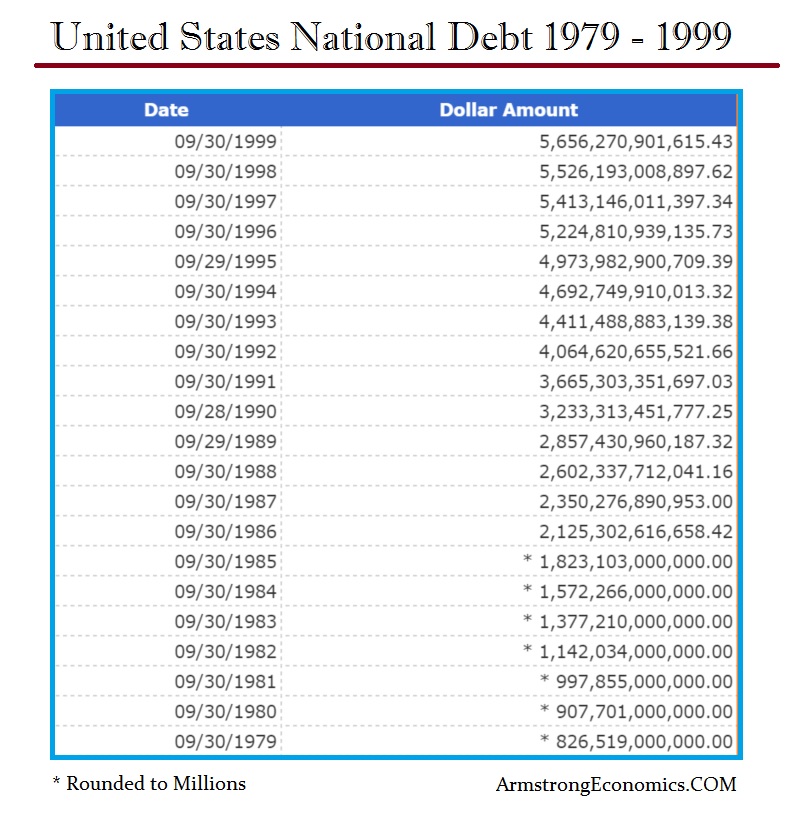

Markets are highly complex. Gold declined for 19 years from 1980 into 1999. The 19 year decline in gold also established clearly that the Quantity of Money Theory and Inflation had no validity at all. Here is the US national debt for the 19 year bear market in gold. The debt rose from almost $1 trillion to nearly $6 trillion which gold declined. You cannot ignore this fact and claim gold will rise based upon the quantity or money and the quantity of money will cause inflation. Both assumptions are totally incorrect.

Markets are highly complex. Gold declined for 19 years from 1980 into 1999. The 19 year decline in gold also established clearly that the Quantity of Money Theory and Inflation had no validity at all. Here is the US national debt for the 19 year bear market in gold. The debt rose from almost $1 trillion to nearly $6 trillion which gold declined. You cannot ignore this fact and claim gold will rise based upon the quantity or money and the quantity of money will cause inflation. Both assumptions are totally incorrect.

They sound entirely logical and are based upon the original theory of supply and demand created by the Scotsman John Law (1671-1729). It took a trader to comprehend the difference between money and confidence the driving force.”I have discovered the secret of the philosopher’s stone it is to make gold out of paper.” John Law: The History of an Honest Adventurer by H. Montgomery Hyde, p83 (London 1969).

Indeed, John Law was just centuries ahead of his time. He could see that the system was all based upon CONFIDENCE and that was the essence of the “bank money” which emerged at the Wisselbank that he observed first hand in Amsterdam. People would accept banknotes provided they had CONFIDENCE in the bank. That is the true value of money which is entirely separate from anything tangible on a one-to-one basis. People stage a run on a bank when they suddenly fear it will close. That is this collapse in CONFIDENCE.

Indeed, John Law was just centuries ahead of his time. He could see that the system was all based upon CONFIDENCE and that was the essence of the “bank money” which emerged at the Wisselbank that he observed first hand in Amsterdam. People would accept banknotes provided they had CONFIDENCE in the bank. That is the true value of money which is entirely separate from anything tangible on a one-to-one basis. People stage a run on a bank when they suddenly fear it will close. That is this collapse in CONFIDENCE.

Without question, all types of monetary standards eventually collapse regardless of what they are based upon. It is the CONFIDENCEwithin that system which gives way. This is what we are starting to experience once again in current times.

Indeed, John Law was just centuries ahead of his time. He could see that the system was all based upon CONFIDENCE and that was the essence of the “bank money” which emerged at the Wisselbank that he observed first hand in Amsterdam. People would accept banknotes provided they had CONFIDENCE in the bank. That is the true value of money which is entirely separate from anything tangible on a one-to-one basis. People stage a run on a bank when they suddenly fear it will close. That is this collapse in CONFIDENCE.

Indeed, John Law was just centuries ahead of his time. He could see that the system was all based upon CONFIDENCE and that was the essence of the “bank money” which emerged at the Wisselbank that he observed first hand in Amsterdam. People would accept banknotes provided they had CONFIDENCE in the bank. That is the true value of money which is entirely separate from anything tangible on a one-to-one basis. People stage a run on a bank when they suddenly fear it will close. That is this collapse in CONFIDENCE. Without question, all types of monetary standards eventually collapse regardless of what they are based upon. It is the CONFIDENCEwithin that system which gives way. This is what we are starting to experience once again in current times.

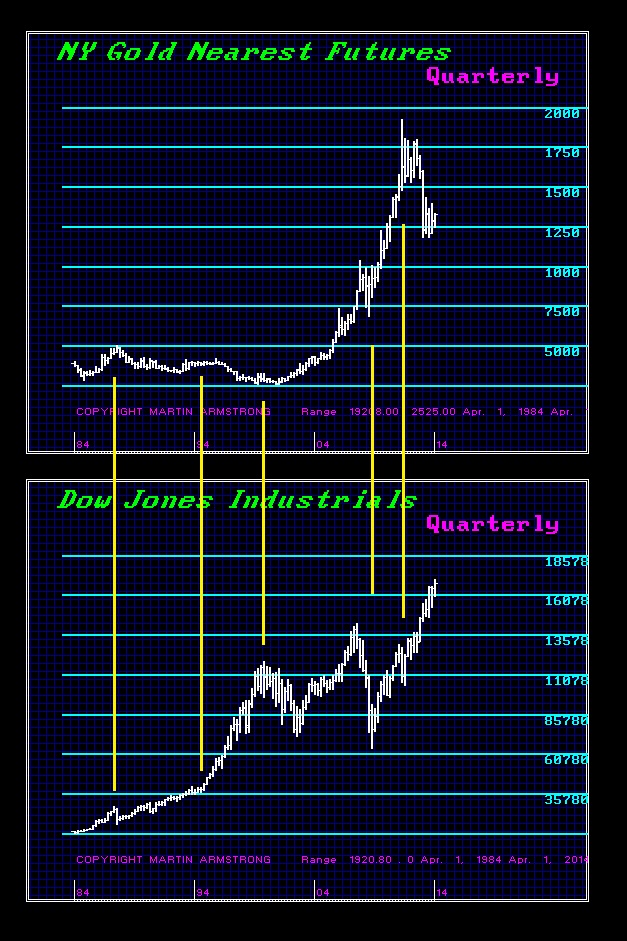

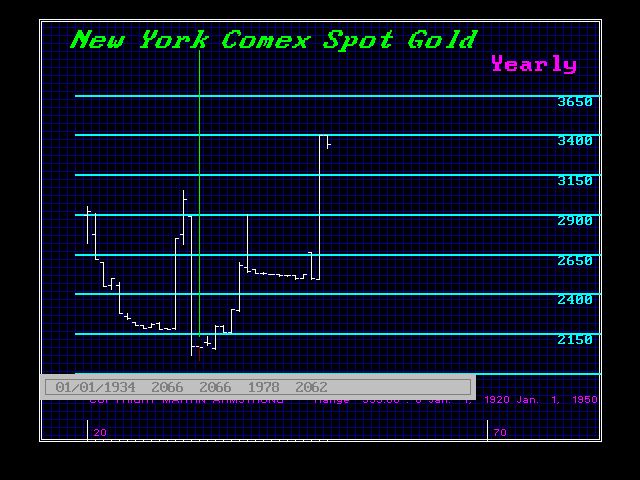

As you can clearly see, there is no such perfect relationship between the Dow and Gold. It moves back and forth within a three-dimensional space with more than a single one-on-one ratio. It entirely depends upon the circumstances and the dynamics of the global economy at that instant in time.

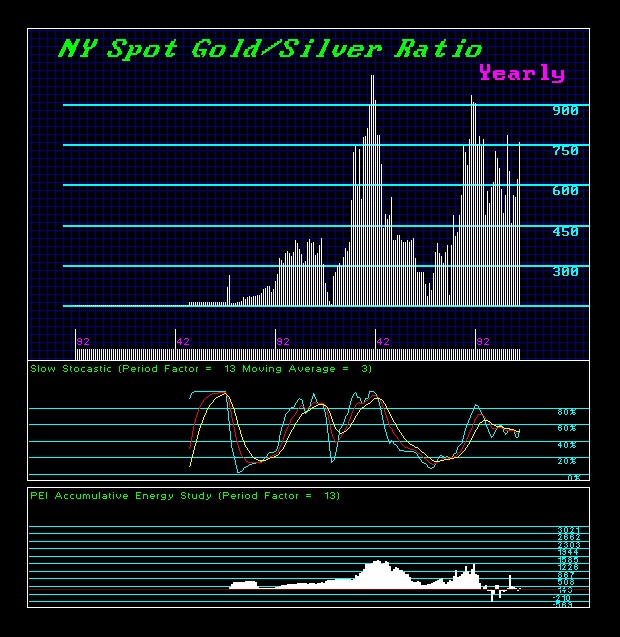

There is also no direct connection between silver and gold either. Here also we have see wild swings with the ratio moving from 120:1 to 8:1 throughout history. There have been times when silver became scare setting off riots because silver was the domestic money and gold international as in Florence. Naturally, the promoters also pick the lowest point an base their forecasts upon that as well. They pray for the collapse in the Dow to raise the Dow-Gold Ratio. This is all very amateurish analysis which becomes sophistry.

Of course it was the silver to gold ratio that became the presidential election topic in 1896 and virtually bankrupted the country because government by decree overvalued silver at 16:1 Here are the words of William Jennings Bryan:

Audio Player

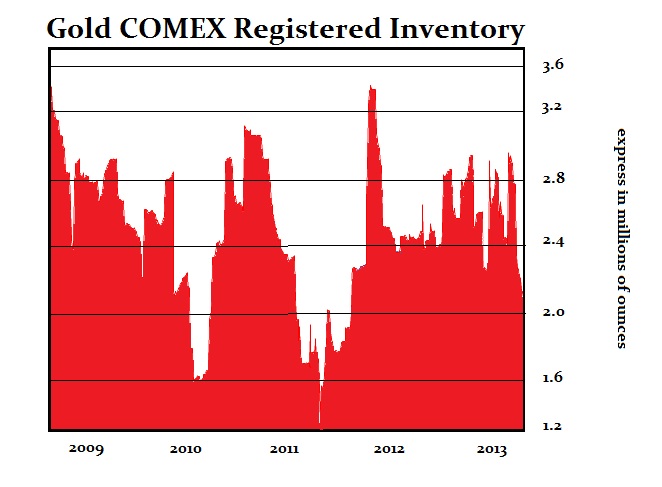

Then there is the classic inventory scam. They convince people inventories have collapsed implying there is a shortage so prices will rise. They moved silver from the US to London to pull off the Buffett Rally. That removed silver from the US inventories and they spun that as justification for the rally. There is no such correlation between inventory at COMEX and price because it has been typically manipulated to impact price. Here was a taped call during that market manipulation between myself and one of the bank dealing desks.

This is the reality of trading. Some say it is largely boring periods interrupted by moments of sheer terror when suddenly your classic theories are proven totally wrong. Perhaps. I suppose if you believe in the standard theories it can be a total confusing upset in the middle of a panic.

Audio Player

00:00

10:34

No comments:

Post a Comment