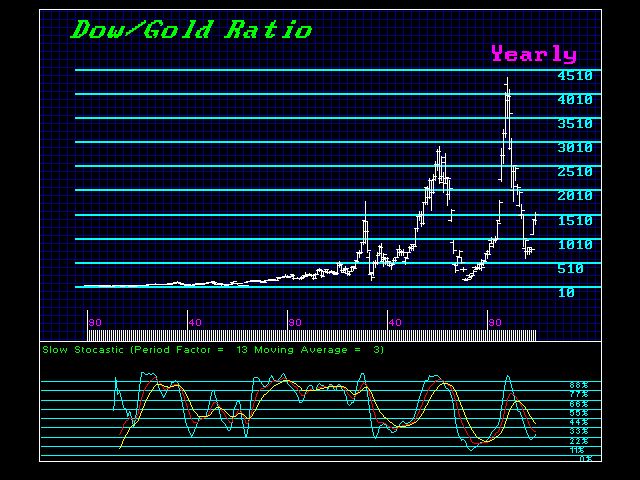

Dow/Gold Ratio

A number of people have written asking about the proposition that gold should rise to be equal to the Dow because that is where it had reach in 1980. Sorry – no way. When gold was $875 in 1980 and the Dow 1,000, that was the end of a Public Wave which peaked 1981.35. The difference between gold and the Dow is very important. Gold is a hedge against government for the individual; it is not an institutional investment. The reason is rather simple – gold pays no dividend.

As we can see from the above chart of this ratio back to 1790, The major support on this ratio is 3 to 3.3 and the resistance stands at 20:1. The low in the ratio took place in 2009 during the panic. Therefore, the decline was more associated with the decline in the Dow rather than gold. To reach that 20 level on a decline in the Dow again would mean if gold went all the way to the Yearly Bearish Reversal at 680 and the Dow made new lows, it would have to reach the 13,700 area.

Nevertheless, the proposition that the Dow and gold should be 1:1 and therefore gold will rise to 20,000, is just pipe-dreams. As this chart illustrates, the relationship is like everything else – a cycle. Picking a 1:1 relationship and claiming that is the NORM, is the same absurdity of claiming the silver gold ration should be 16:1 because that is what Congress did during the 19th century when the open market was 30:1 by the Panic of 1893. These types of relationships are by no means realistic just distorted delusion to sell precious metals.

No comments:

Post a Comment