Bubble Bubble Where is the Bubble

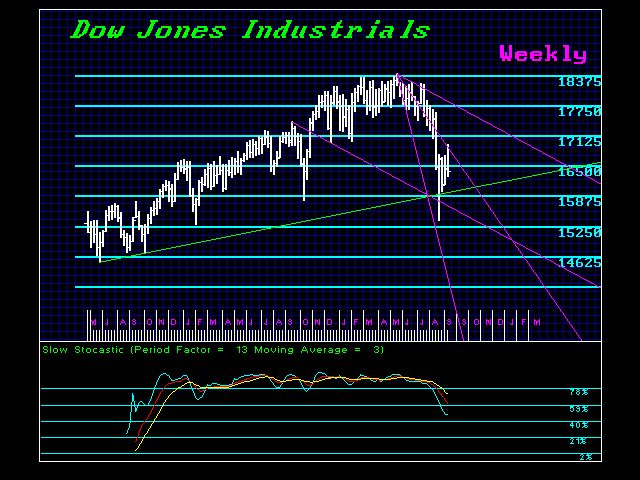

It is fascinating that when I warn of anything using the word “CRASH” newspapers immediate report it as I am forecasting a crash in the stock market. This demonstrates that there is no consideration that government can also crash and burn – the perfect example of 100% confidence. Yes, if this week simply closes on the Dow below 16280, then we can be looking at that slingshot move I have warned about where in one year, we have a crash and a swing to the upside to new highs. These type of events are the ultimate mind game, but that is how they destroy the majority. As for those who write asking which investment will be safe – the answer is NONE.

While those who distort the events of the Great Depression to sell gold or whatever, keep in mind that commodities peaked in 1919 and bottomed WITH stocks in 1932. Real Estate peaked in 1927 followed by bonds when the Fed cut rates to try to help Europe, then everything reversed and stocks soared in 1929 and then crashed and burned into 1932 bottoming with commodities.

While those who distort the events of the Great Depression to sell gold or whatever, keep in mind that commodities peaked in 1919 and bottomed WITH stocks in 1932. Real Estate peaked in 1927 followed by bonds when the Fed cut rates to try to help Europe, then everything reversed and stocks soared in 1929 and then crashed and burned into 1932 bottoming with commodities.

There was NO SINGLE INVESTMENT left standing– ABSOLUTELY NOTHING. So why the charlatans are trying to sell you newsletter with promises of if you just bought this letter you will make 20,000%, keep in mind this is a period of survival we are entering – not wild speculation. If you do not understand the nature of the beast, the beast will have you for lunch.

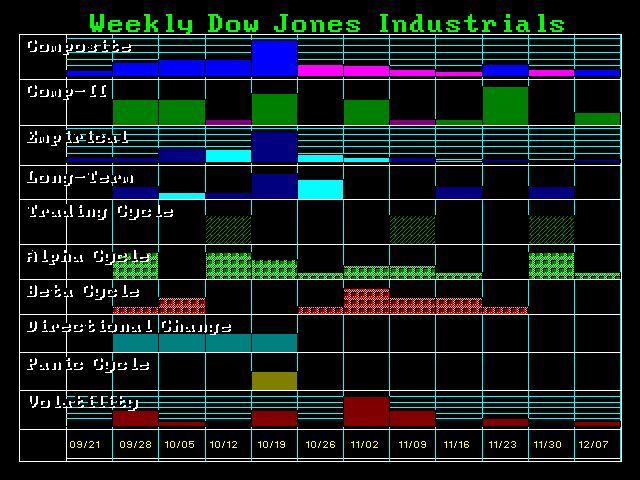

So what we have to grasp here is that this is a well organized collapse. Each sector will collapse and in turn set in motion the next. If we get this week-end closing below 16280, then we may be headed for a retest of the August low going into October.

This will be the most difficult period ahead to actually forecast so pay attention. We are entering a period of chaos that BEGINS with 2015.75, it does not end there with some crash. THIS IS BEGINNING not the END.

Remember, if the stocks decline into 2015.75, that should push more and more capital into government bonds completing the BUBBLE. This is by no means a BUBBLE in stocks, commodities, or the dollar. This is a peak in GOVERNMENT. This is not even a Kondratieff Wave based upon commodities. This is the 309.6 year cycle in government and unfortunately, the other side of 2015.75 is not looking very pretty. This not about just the collapse of Europe. This is the collapse of Western forms of government that aids the shift in the financial capital of world to China by 2032. These shifts in global economic trends are measured in hundreds of years and unfortunately, we have a front row seat. It’s Just Time.

No comments:

Post a Comment