Interest Rates will Double

Posted Nov 10, 2017 by Martin Armstrong

QUESTION: Mr. Armstrong; Thank you for an excellent conference. I have been attending since 2011. Each time you deliver a different conference and they are always better than the last. I could not help to notice on Zero Hedge they ran a piece about a Harvard University’s visiting scholar at the Bank of England who claims:

“We trace the use of the dominant risk-free asset over time, starting with sovereign rates in the Italian city states in the 14th and 15th centuries, later switching to long-term rates in Spain, followed by the Province of Holland, since 1703 the UK, subsequently Germany, and finally the US.”

Besides claiming to calculate the 700-year average real rate at 4.78% suggesting that rates will rise sharply when your models are 5,000 years, the two ridiculous statements are a 700-year average as if this really means something in the near-term when rates have been below that for nearly 10 years, and second the statement that he traces “the dominant risk-free asset over time.” You have demonstrated that moving averages are not valid in forecasting and that government routinely defaults.

You forecast at the conference that rates would rise very rapidly as we move into the Monetary Crisis Cycle. When I returned home to Greece, the latest news here is that so many people do not even have the money left to pay taxes. Is this part of the first stone in the water that sets off the waves of the Monetary Crisis Cycle?

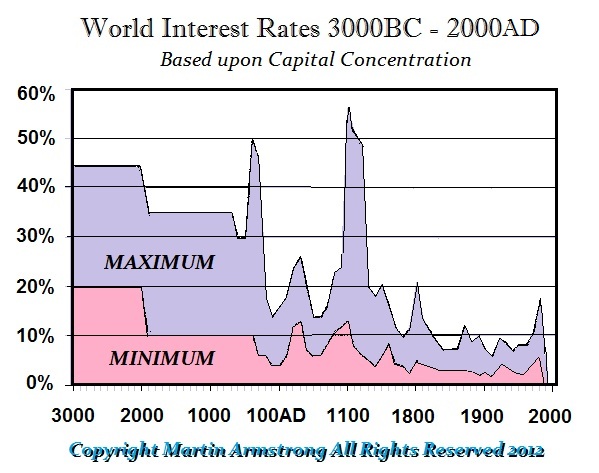

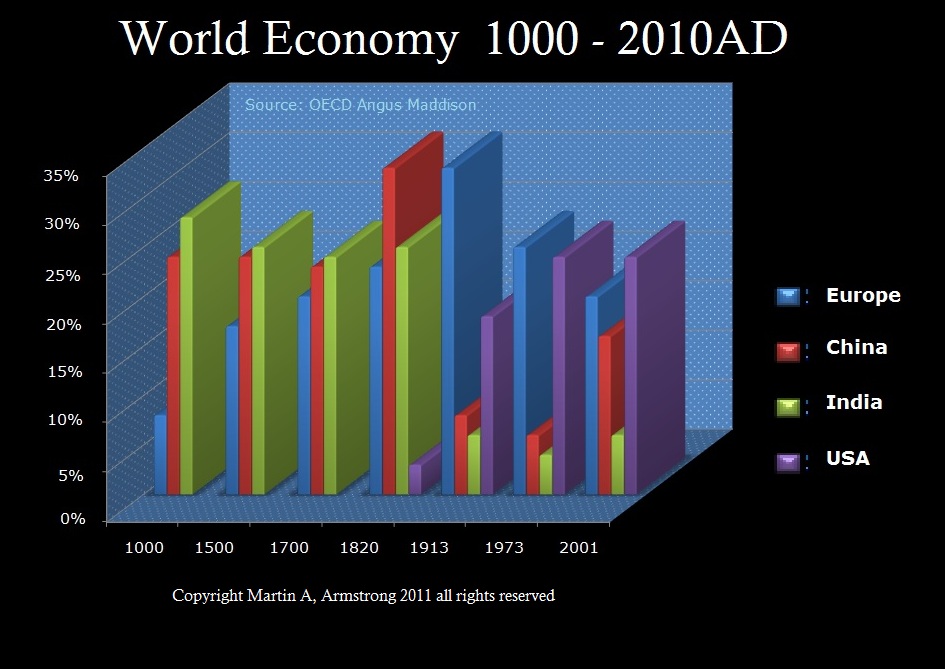

ANSWER: It is very nice to trace 700 years and come up with the average of 4.78% by switching to the dominant economy as the financial capital of the world moved. However, starting the study in the 14th century skips the crazy part. There was the Great Financial Crisis of 1092 in Byzantium. This was really a watermark event that set in motion the decline thereafter. This study of moving from Spain to Holland, UK, Germany, and then the USA, is interesting, but regionally biased.

The fall of Byzantium resulting in the financial capital of the world moving to India – not Spain. That is why Columbus set sail trying to get to India, which was the financial capital of the world after Byzantium.

We hit a 5,000 year low. The Reversals we provided at the conference show we are looking at a near doubling in rates when we cross that number.

No comments:

Post a Comment