Trading by Systems

Blog/Forecast

Posted Jan 27, 2018 by Martin Armstrong

QUESTION: Can you trade with the Global Market Watch? Does experience count right now with what you call a Vertical Market?

DS

ANSWER: No. It is an alert to wake you up, not a trading tool. It will alert you to breakouts, waterfalls, highs, or lows. It is not a 100%. It is far better on the major markets than perhaps individual stocks. It can be a great confirmation tool.

Trading this kind of market is probably more dangerous for those who have trading experience. The reason why is they are used to trading normal markets. This is why they have tried to sell every high as the US share market has rallied making new record highs. Their “experience” actually defeats them.

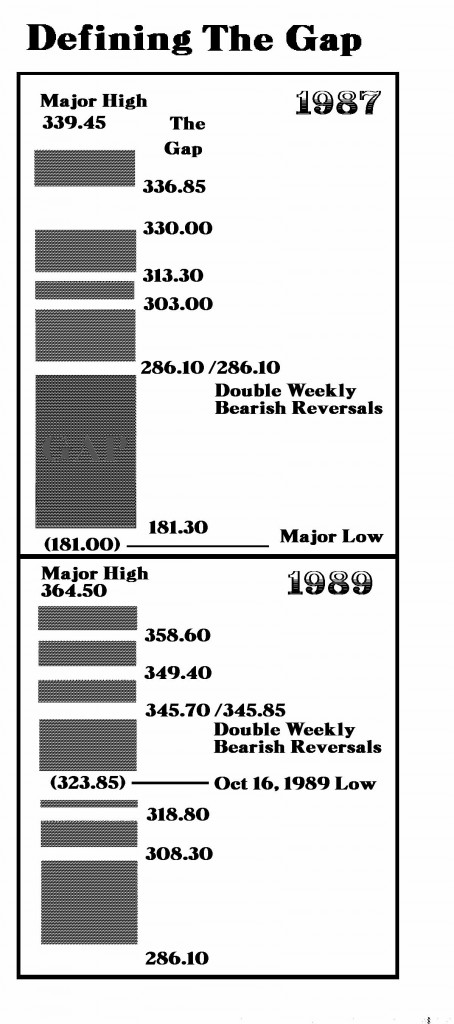

The 1987 Crash was the perfect example. The government was hunting for the person who caused the crash. What they discovered was that they did use computer programs, but they did not follow them because the Dow was down 500 points and they thought there would be a bounce because there was no fundamental explanation. That is when it took out a rare set of Double Weekly Bearish Reversals and we had a gap down to 180 from 286.

The Brady Commission discovered it was not computer trading that caused the crash. It was currency. The big funds unplugged their computers because they did not believe them. So EXPERIENCE can also work against you if you trade especially daily. You see the short moves and miss the big events.

The Reversals are the best tool, and then the cycles help to hone in on the turning points. The Global Market Watch is a pattern recognition model so it is really an alert system that tells you to the look at the detailed reports. We can judge the magnitude of possible moves by looking at the gaps in the Reversal system.

No comments:

Post a Comment