Internal Migration – The Cycle or City States

Posted Jan 28, 2019 by Martin Armstrong

There is an interesting book entitled The Chinese Exodus. This work explores the sociological and theological discussion going on concerning China’s internal migration since the marketization reform in 1978. While the book documents the social and political processes impacting the experiences of internal migrants from the countryside to the city within China, the attempt is to reconstruct the political, economic, social and spiritual dimensions of this urban underclass in China who made up the economic backbone of the Asian superpower.

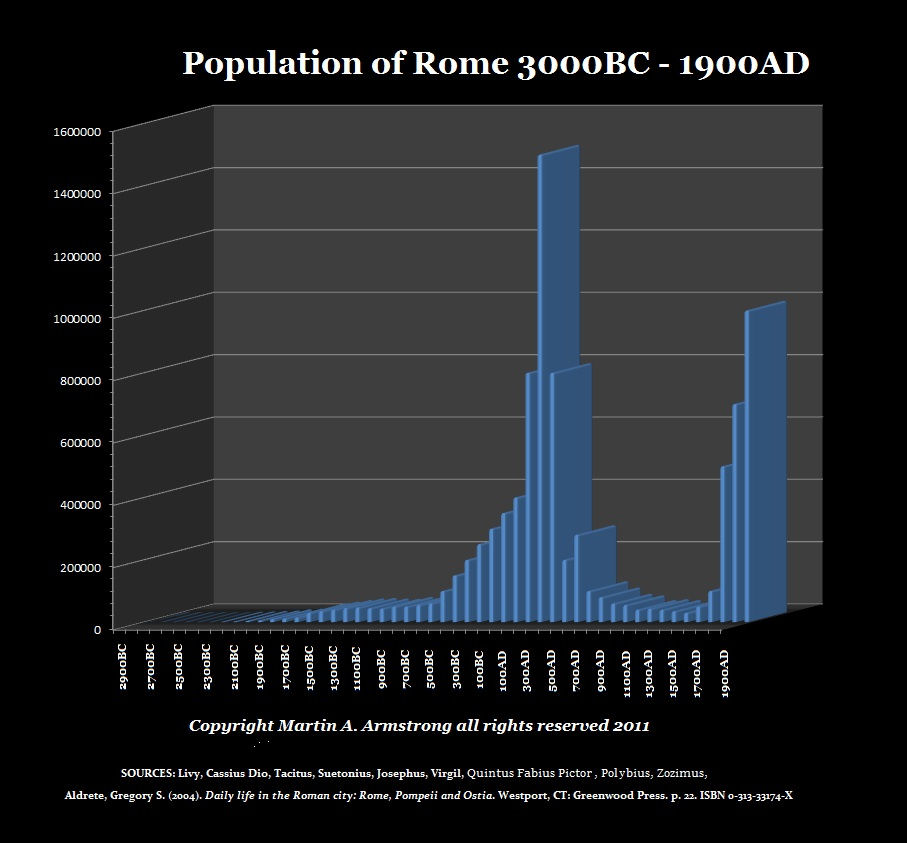

History repeats BECAUSE human nature never changes. Humans will ALWAYS act in the same manner to the same set of circumstances no matter what culture or century. Yet what is more interesting to me is the pattern. As taxes are low and the economy booms in the city, the youth are attracted to the city and leave their parents in the farms or suburbs and head off to make their fortune in the world. Rome became the largest city in history reaching a population in excess of 1 million by its peak in 180AD. It had crossed that 1 million mark in 133AD during the reign of Hadrian (117-138AD). With the death of Marcus Aurelius in 180AD, the decline and fall began. Gradually the population declined until it fell to just 15,000 during the middle ages. The city of London, England reached the 1 million mark in 1810 during the reign of George III (1760-1820) and New York City finally reached that level in 1875.

Our understanding of the economy is incredibly important, yet it is completely ignored by those in power. Nothing is possible without a properly functioning economy for the very existence of civilization depends entirely upon the function of the economy. People come together from the suburbs to form great societies in a trend of urbanization only when it is to the advantage. Historically, when the government loses sight of their purpose and sees itself as the embodiment of sovereignty instead of the people, then it begins to abuse the people with regulation and taxation. Once that takes place, the trend of coming together is reversed.

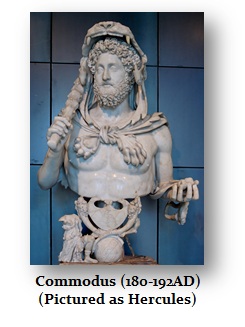

Edward Gibbon wrote in his Decline and Fall of the Roman Empire about the son of Marcus Aurelius and how he set in motion the collapse of Rome. He wrote of Commodus (177-192AD):

“distinction of every kind soon became criminal. The possession of wealth stimulated the diligence of the informers; rigid virtue implied a tacit censure of the irregularities of Commodus; important services implied a dangerous superiority of merit; and the friendship of the father always insured the aversion of the son. Suspicion was equivalent to proof; trial to condemnation. The execution of a considerable senator was attended with the death of all who might lament or revenge his fate; and when Commodus had once tasted human blood, he became incapable of pity or remorse”

(Book 1, Chapter 4).

When the people begin to flee the cities because of corruption and taxation, the Romans had a word for it “suburbium” meaning the people began fleeing from the cities to what we call today suburbia. The population of Rome itself just collapsed. This is how empires die. The cost of government always rises to oppress the private sector since the public sector becomes addicted to revenue. The people either leave or revolt in their struggle to cope with the persistent unpredictable demands of the government that historically NEVER lives within its means.

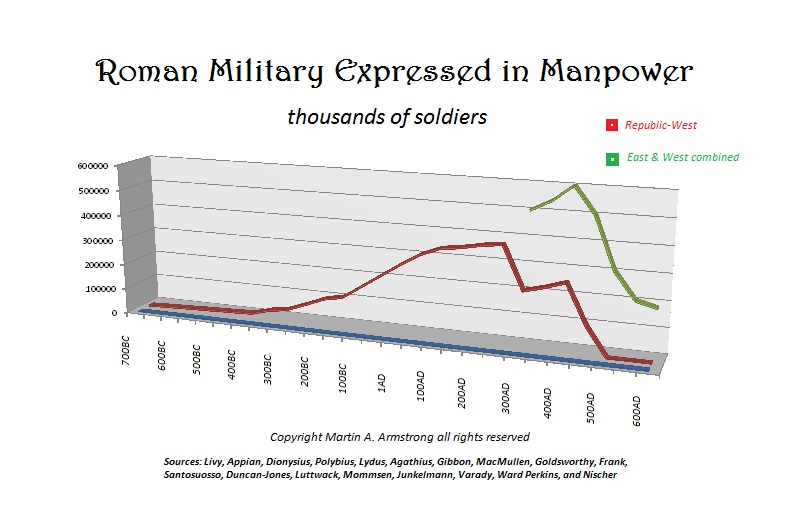

In the earliest days of the Republic, Rome’s taxes were quite modest, and were not direct, but were a property tax or a wealth tax on all forms of property, including land, houses, slaves, animals, money and personal effects. The basic rate was just 1% and sometimes it would occasionally rise to 3%. This was to fund the pay for the army during the war. The tax would often be rebated to the people out of the spoils of war. It was levied directly upon individuals, which required the government to conduct a census.

In the earliest days of the Republic, Rome’s taxes were quite modest, and were not direct, but were a property tax or a wealth tax on all forms of property, including land, houses, slaves, animals, money and personal effects. The basic rate was just 1% and sometimes it would occasionally rise to 3%. This was to fund the pay for the army during the war. The tax would often be rebated to the people out of the spoils of war. It was levied directly upon individuals, which required the government to conduct a census.

The flat tax of Augustus (27BC-14AD) created the biggest economic boom in Roman history. Augustus once said, “I found Rome a city of bricks and left it a city of marble.” Indeed, Augustuscommissioned several large marble structures, some of which took 40 years to complete. There was evidence that massive marble blocks were constantly being moved through the city, causing congestion in the streets. Marble-paved public spaces began to appear where marble was previously reserved for sacred temples and houses of the elite. The flat tax system really did create the economic boom as people turned to peace and business – Pax Romano.

Rome became prosperous because it began with the conquest model whereby it consumed the wealth of the nations it conquered. Once Rome had expanded and there was no longer anything worthwhile to bring home wealth, then the cost of maintaining its borders and security became unsustainable. The pension system it had created which we still use in government to this day where 20 years of service gets you a pension, acted like cancer which devoured the Empire from within. As this weakened its defenses, then the barbarians were able to invade.

Consequently, the fiscal mismanagement of Rome and its economic model of conquest failed. This led the government to turn inward against its own people that resulted in not merely the collapse of the Rule of Law, but that opened the door ‘for wider demands for taxation and the confiscation of property under the pretense of some offense. The over taxation of the people caused the suburbanization of Roman culture as they fled the cities. As the government tried to stretch its grasp of taxation, they were, in fact, planting to the seed of its own destruction. Taxation is not a divine right of government. It is to be limited to the voluntary contribution from the people to share the benefits of communal living. Once taxation is seen as a divine right of government this will lead to the diminished rights of the people and then the rise of economic tyranny.

Historically, this has been the difference between movable and immovable assets, such as real estate. Collectibles, stocks, and precious metals are in the moveable category. Of course, this is what governments are now attempting to seize. If we look at the fall of Rome, the first asset class to decline was real estate, as you cannot take it with you when you leave town. Thus, the population of Rome collapsed from 1 million to 15,000 by the Middle Ages. People had no choice and just walked away, unable to pay the taxes demanded.

Taxes are the great destroyer. You are an economic slave if you simply cannot retire without having to pay taxes. Taxes reduce economic growth and lower productivity for they are no different, economically speaking, from some gangster demanding “protection” money to operate a business. Rome prospered as long as it had a minimal flat tax. The Democrats preach they want to tax the rich, but what they actually do is create higher tax rates with all sorts of deductions they sell to lobbyists for big campaign donations. A flat tax is far more economically more of an incentive and it will be closer to the indirect taxation that the Founding Fathers incorporated into the Constitution until the Marxists alter everything.

The cycle is very clear. First, we have the attraction of the city with low taxes and regulation where people come together to create economic booms. Governments will then become greedy with taxes and over-regulation. This will then lead to the downside of the Bell Curve and result in the death of the empire, nation, or city-state. It is always the same pattern no matter what century or culture.

No comments:

Post a Comment