Posted Sep 18, 2019 by Martin Armstrong

QUESTION: Hi Marty… I’ve been reading your blog for several years now.

I’ve been trying to understand the basics about your reversal system is with no luck.

Yet I’ve been trading stocks with only simple trend lines for years using basic tech A.

Yet I’ve been trading stocks with only simple trend lines for years using basic tech A.

PS I still don’t even understand how the Federal Reserve works either… they don’t teach you that stuff in high school!

Yes, I’ve watched every video or post on reversals on your site and not getting it. I know I’m not that smart but I’m not that dumb either!

Can you pretty please post a very clear layman’s chart using a stock or a commodity with prices like gold to show us dummies so we “GET IT”

Thanks Marty….

A dumb Canuck

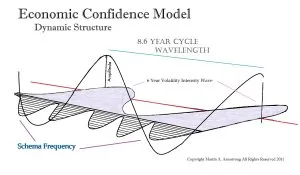

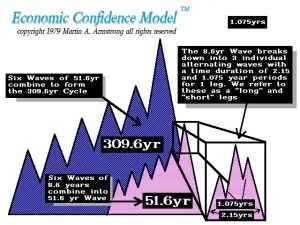

ANSWER: Look, the reversals are a black box and I keep it that way along with the Schema Frequencies. This is a physics solution to how the world ticks. It is not a simple moving average, stochastics, or one-dimensional formula. It is highly complex and many people have tried to reverse engineer it but have failed. They may think they have come close but they cannot account for the next number.

Traditionally, economists argue there is a business cycle, but nobody can forecast the cycle. Therefore, with tools of interest rates, taxes, and money supply, governments can manipulate the business cycle. The problem is that even Larry Summers admitted that he cannot forecast the economy. This stems from the problem of their failure to understand cyclical movement,to begin with. The Schema Frequencies resolve the complexity of cyclical movement.

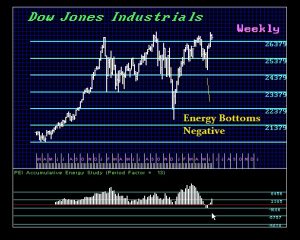

The Energy indicator is against based upon physics and it exposes the true opposing forces at work irrespective of the superficial price levels. The key to this is looking for the divergence when prices are rising and Energy is declining. This is a warning signal that such a rally is NOT sustainable. Likewise, when prices are falling but Energy begins to rise, once more there is a divergence warning that the decline is losing energy and a low is near. Just look at this daily chart on gold. You can see the divergence as Energy peaked well in advance.

These indicators are not your standard variety of analysis. They are entirely beyond the one-dimensional analysis world for the markets are not only all connected globally, but the entire system is fractal. So we have a fractal relationship within each market and then a fractal relationship on a global perspective.

The models do all the calculations that are humanly impossible to carry out before a market even closes. It allows us to stand back and see the overview which then reveals the trends. Many have tried to prevent our forecasts. They have tried to ignore what this computer has been doing in hopes that I will die and that will be the end of it. I see this as a means to an end — to help society manage the business cycle without destroying our human rights and our freedom. I have to protect this because there are those who would use it behind the curtain for personal gain against the world.

Sometimes in life, we stumble upon something like the discovery of penicillin. It has saved lives. People just accept that and do not need to know the formula behind it

No comments:

Post a Comment