The Fed & Helicopter Money

Posted Mar 13, 2020 by Martin Armstrong

QUESTION: You said that the Fed does not print money out of thin air on its own. The goldbugs say you are wrong. I suspect that they are wrong not you. You seem to have a much deeper understanding of money than anyone else. Would you clarify this issue?

Thank you very much

PHK

ANSWER: When Congress created the Federal Reserve, a completely new currency came into existence. There were two types of currency issued under the Federal Reserve.

1. The main system currency was simply known as the Federal Reserve notes.

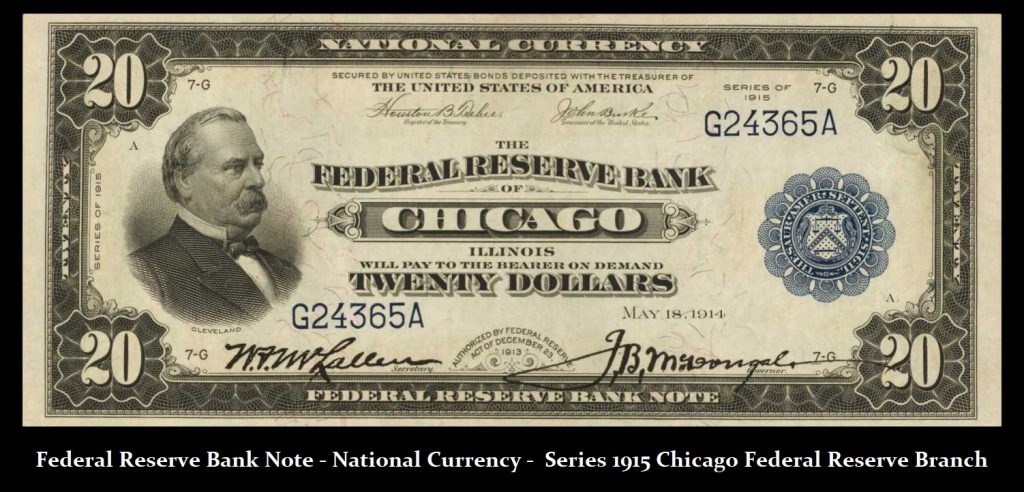

2. Then there was the Federal Reserve Bank notes that were issued by the independent branches. The Federal Reserve Bank notes are inscribed “National Currency.”

The first series to be issued by the indeed the jewel banks of the Federal Reserve was dated 1915 and consisted only of $5, $10 and $20 denominations. They were only issued by the Atlanta, Chicago, Kansas City, Dallas, and San Francisco. The obligation of this issue was to pay the bearer on demand only by that specific Federal Reserve branch. The 1915 series stated it was “secured by United States bonds deposited with the treasurer of the United States of America.” The later issue of 1918 stated, “secured by the United States bonds or the United States certificate of indebtedness or United States one year gold notes deposited with the treasury of the United States of America.”

The Federal Reserve notes of 1914 were issued in all denominations from $5-$10,000. They were issued by the United States to the 12 Federal Reserve banks and threw them to the member banks and to the public. The notes were not issued by the banks themselves as were the Federal Reserve Bank notes and the obligation to pay the bearer is borne by the government and not by the banks. Hence, these notes were not secured by the United States bonds or other securities. Therefore the Federal Reserve notes were not secured by any certified means of backing. The Federal Reserve notes simply states, “United States of America will paid to the bearer on demand.”

The difference was substantial. The Federal Reserve Note was directed to be issued to create money which was unbacked even by bonds. This was to create liquidity because people were hoarding money uncertain about the future. The currency actually issued by the Federal Reserve Banks was backed by government bonds which was a different structure all together. They seem to confuse the authority to create elastic money where they can issue money to buy government bonds injecting liquidity which is not printing money out of thin air but on an elastic basis which is electronic, not printed. The image of the Fed creating helicopter money is not correct.

The ECB has that authority because it cannot back the currency with federal bonds that do not exist. The ECB has the power to create money without backing whereas the Fed can issue notes only backed by federal bonds. The euros are actually printed by each of the member states and not by the ECB directly. Each note has a code stating which nation state issued the currency

No comments:

Post a Comment