The Fed & the Future

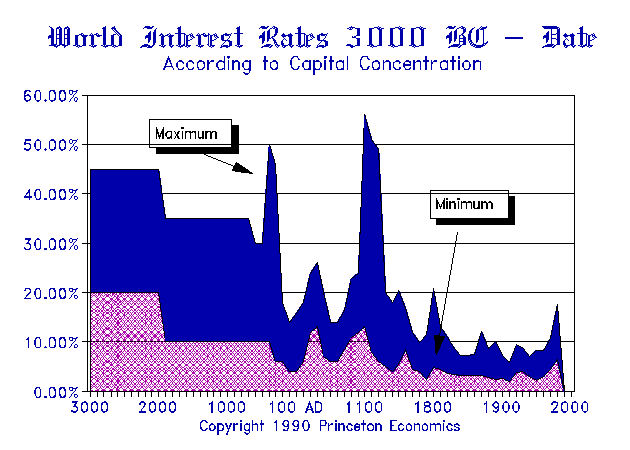

While everyone seems to place a huge question of will the Fed raise rates or not, the markets have factored in the rate rise already for sometime. The Fed was scheduled to raise rates in June, but the IMF turned to the press to criticize them to prevent rate hike. Then in September, the IMF, ECB and other governments all pleaded with the Fed not to raise rates.. The trend will change. The Fed has no choice and that seems to be what the pundits do not get. We can see that rates are BELOW the historic low of the Great Depression. But they are also at a 5000 year low in interest rates on a global scale as well.

While everyone seems to place a huge question of will the Fed raise rates or not, the markets have factored in the rate rise already for sometime. The Fed was scheduled to raise rates in June, but the IMF turned to the press to criticize them to prevent rate hike. Then in September, the IMF, ECB and other governments all pleaded with the Fed not to raise rates.. The trend will change. The Fed has no choice and that seems to be what the pundits do not get. We can see that rates are BELOW the historic low of the Great Depression. But they are also at a 5000 year low in interest rates on a global scale as well.

The Fed is not faced with a bubble that it sees so others like Larry Summers tell the Fed they should not raise rates. Yet Summers admits they cannot forecast the business cycle saying it is far too complex. At the same time, Summers admits that the Fed typically needs to lower the rates in a recession by 3% and it has no such room from here. This is the conventional view. They can never see anything coming anyway so they just try to forecast whatever trend is in motion should stay in motion.

The crisis is more than Hedge funds going belly-up in Fixed Income. The same is unfolding in Pension Funds. Keeping rates low to try to “stimulate” borrowing lowers the value of money to zero and you wipe out savings for something that has never worked. Then we have taxation and enforcement rising which even Keynes said was wrong during a recession. This is all about greed of politicians and nothing else. There is no giant conspiracy controlling the world. No one in their right mind would run it this way. We are flying in a plane where the pilot died at the wheel and nobody knows because the cockpit door is locked. None of the theories they use to control society have ever worked which is why the “crowd” has NEVER been able to forecast a single economic change in trend.

The crisis is more than Hedge funds going belly-up in Fixed Income. The same is unfolding in Pension Funds. Keeping rates low to try to “stimulate” borrowing lowers the value of money to zero and you wipe out savings for something that has never worked. Then we have taxation and enforcement rising which even Keynes said was wrong during a recession. This is all about greed of politicians and nothing else. There is no giant conspiracy controlling the world. No one in their right mind would run it this way. We are flying in a plane where the pilot died at the wheel and nobody knows because the cockpit door is locked. None of the theories they use to control society have ever worked which is why the “crowd” has NEVER been able to forecast a single economic change in trend.

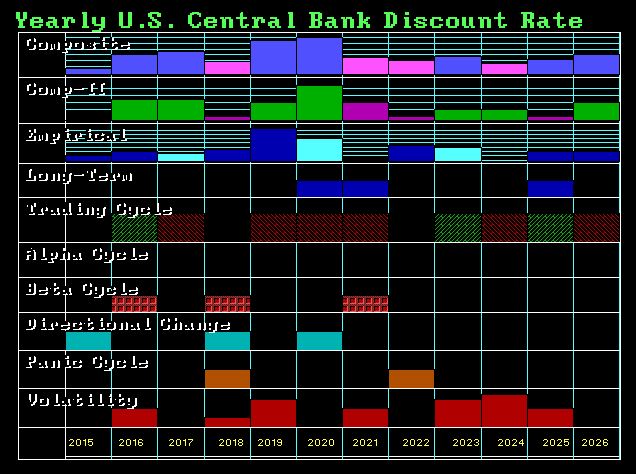

Looking ahead, there is absolutely no question that rates will go nuts. It appears that the Fed pressure will rise sharply in March. Do not forget, that as capital flows into the USA, we will see asset inflation (stock market rise) and the gap between the non-investing and those who invest (“rich”) will widen. This will increase the pressure on the Fed to raise rates to stop the bubble, which will be caused from external sources and not some socialistic agenda.

We will be putting together a special report on the Yield Curve which will go nuts and really create tremendous problems for central banks, hedge funds, and be the real harbinger of chaos. This will be announced when ready after the 1st of the Year. So for now, sit back and enjoy the show. The longer the Fed has appeased the rest of the world, the worse the future has become. Money has a value and it is not ZERO.

PS: Inside Socrates we have the Fed Discount rate, VIX, and Fed Funds.

No comments:

Post a Comment