COMMENT: If the Fed is so smart and understands the problem with low/negative interest rates, then why didn’t it hike rates in September? Better yet, why didn’t they raise rates YEARS ago? The Fed has kept rates near zero for seven years but now suddenly realizes that this is a problem?

I am surprised that you think so highly of them. The Fed consists of a bunch of academics with no real-world experience, no different than the ECB.

REPLY: Your bias and prejudice blind you. The ECB is run by Mario Draghi who is ex-Goldman Sachs. Mario Draghi faces a currency that is collapsing and a power structure that is fundamentally flawed. This is entirely different from the problems facing the Fed. Europe is in deep recession that is intensely deflationary. That is not the case yet in the USA.

REPLY: Your bias and prejudice blind you. The ECB is run by Mario Draghi who is ex-Goldman Sachs. Mario Draghi faces a currency that is collapsing and a power structure that is fundamentally flawed. This is entirely different from the problems facing the Fed. Europe is in deep recession that is intensely deflationary. That is not the case yet in the USA. Yellen has inherited a nightmare. It was Ben Bernanke who made the mess we are in today. He lowered rates, bought in long-term bonds the Fed cannot now sell and must wait for them to simply mature. Yellen is trapped for she cannot reverse QE and sell the bonds Bernanke bought and she is facing a meltdown in pension funds because rates are too low for too long. Yellen has no escape. You are also blind to how politics functions and all you are doing is listening to the bullshit that is spun by pretend analysts who know nothing about what really goes on behind the curtain.

Yellen has inherited a nightmare. It was Ben Bernanke who made the mess we are in today. He lowered rates, bought in long-term bonds the Fed cannot now sell and must wait for them to simply mature. Yellen is trapped for she cannot reverse QE and sell the bonds Bernanke bought and she is facing a meltdown in pension funds because rates are too low for too long. Yellen has no escape. You are also blind to how politics functions and all you are doing is listening to the bullshit that is spun by pretend analysts who know nothing about what really goes on behind the curtain. The mere fact that the IMF came out publicly to ask the Fed not to raise rates in June was a political maneuver to counteract Yellen. Things of this nature are discussed behind the curtain – never in front. The IMF turned to the press to STOP Yellen because she would have raised rates back in June. It was Ben Bernanke who listened to the bankers and created insanity.

The mere fact that the IMF came out publicly to ask the Fed not to raise rates in June was a political maneuver to counteract Yellen. Things of this nature are discussed behind the curtain – never in front. The IMF turned to the press to STOP Yellen because she would have raised rates back in June. It was Ben Bernanke who listened to the bankers and created insanity.

It is clear that Ben Bernanke lacked any experience as an academic to run the Fed. He became a professor at Harvard after graduating. If you have no real world experience, you will never understand reality. Book smart does not cut it in finance.

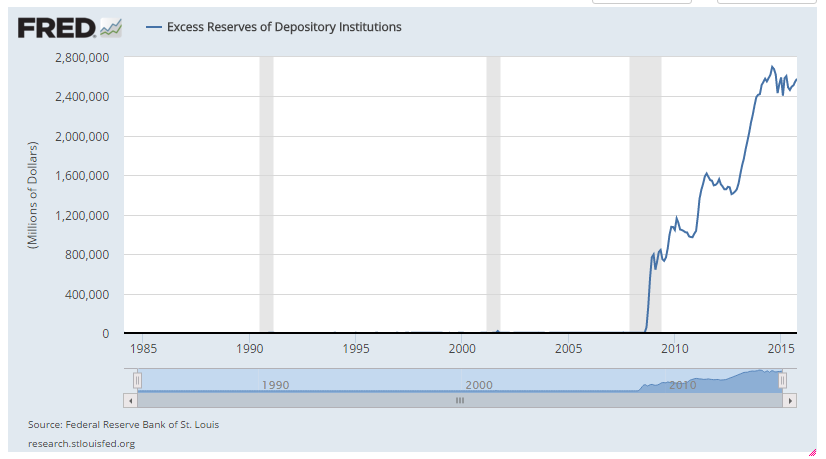

Bernanke bought in 30 year bonds to help reduce the competition with mortgages and to inject cash into the system from a very book perspective looking at the economy in theory, not in reality.. The bankers then complained they needed excess reserve facility to earn money if they had no more bonds. Creating this facility defeated the very purpose of QE and ensured that there would be no inflation for the banks did not lend the money out. The money created did not stimulate for two reasons. First, the Chinese sold their long-term debt holdings and reduced their maturity. Then the excess reserves allowed banks to park money rather than lend it. Dropping rates to virtually zero and paying the banks 0.25% defeated everything intended to restart liquidity and inflation.

Hence, the Fed is in danger of losing its sovereignty allowing itself to delay its domestic policy objectives for international concerns. Your bias and prejudice prevent you from even seeing what the crisis is all about..

BTW – that highway bill has emerged from a House-Senate conference committee that will pay for the roads by reducing the 6 percent annual dividend paid to the banks on Fed stock. The Fed should now eliminate the excess reserve facility and stop the welfare for the banks paying them for money the Fed does not even use.

No comments:

Post a Comment